Strategic Triumphs Propel Burberry's Q3 Success and Future Outlook

Sustained Growth in Retail Performance and Revenue Quality Enhancement

For the third quarter of fiscal year 2026, ending December 27, 2025, Burberry achieved a commendable 3% year-on-year increase in comparable retail sales, reaching £665 million on a constant currency basis. This growth underscores the brand's resilience and effective market strategies. Furthermore, the company proudly confirmed its full-year outlook, projecting revenues to range from a 0% decline to a 3% increase, with comparable retail sales growth estimated between -1% and 4%. A pivotal factor in this success has been the noticeable improvement in revenue quality across all sales channels and geographic regions, alongside the effective implementation of a more concise and less aggressive markdown strategy.

The "Burberry Forward" Initiative: A Catalyst for Momentum

Joshua Schulman, Burberry's Chief Executive Officer, expressed satisfaction with the progress made during the festive quarter, attributing it to the ongoing success of the "Burberry Forward" strategy. He noted a sequential enhancement in comparable sales growth and a superior quality of revenue across diverse channels and geographical markets. As Burberry approaches its 170th anniversary, these encouraging outcomes serve as a testament to the enduring appeal of its brand identity and instill confidence in its future trajectory.

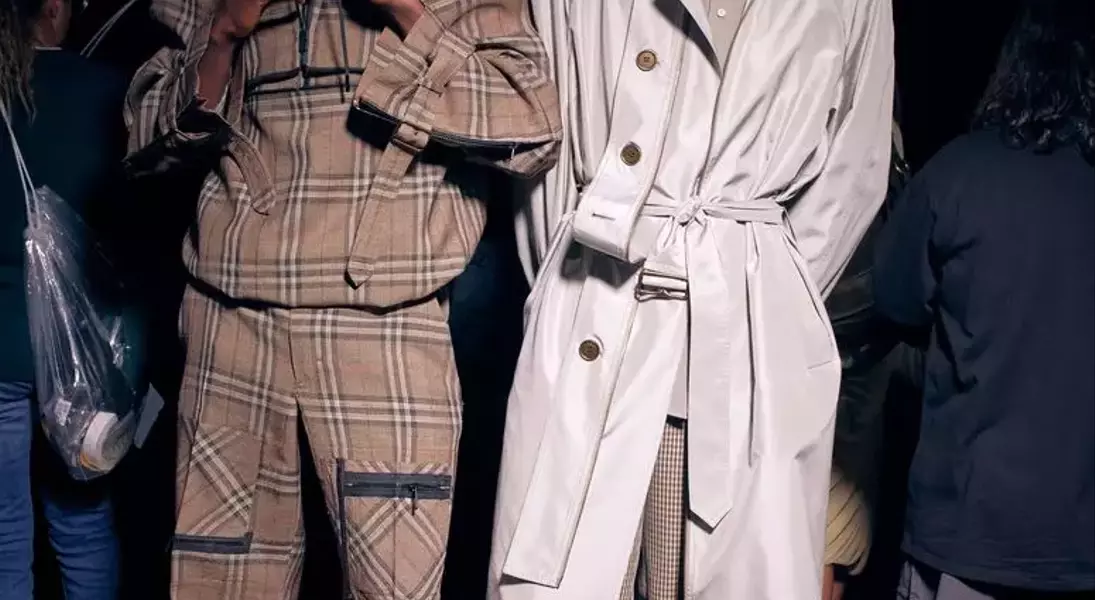

Outperforming Categories: Outerwear, Scarves, and Emerging Strengths

Core product lines, notably outerwear and scarves, demonstrated exceptional performance, both recording double-digit sales increases. To further capitalize on these strengths, Burberry has optimized retail productivity through enhanced visual merchandising efforts, including the successful launch of 190 Scarf Bars, with plans to reach 200 by year-end. Schulman highlighted the particular appeal of scarves to a younger demographic, serving as an accessible entry point to the brand. Additionally, handbags and ready-to-wear categories, especially knitwear, are beginning to show promising momentum. Schulman emphasized the widespread success of Burberry's Equestrian Knight cashmere sweater during the holiday period, indicating that the strength in core outerwear is now positively influencing accessories and ready-to-wear segments.

Geographical Strongholds: China Leads, Asia-Pacific and Americas Contribute

Greater China, which constitutes approximately one-third of Burberry's total business, emerged as the leading market, reporting a 6% increase in comparable store sales, primarily fueled by local consumer spending. Schulman reiterated China's critical role in Burberry's strategy, emphasizing the brand's long-standing focus on Chinese customers and their significant contribution to the customer base. He noted that the "Burberry Forward" strategy's second year has seen strong connections forged with customers across various age groups and demographics in both major and secondary Chinese cities, reaching a broad luxury audience. Sales across the rest of the Asia-Pacific region saw a 5% uplift, driven by both tourist and local demand in South Korea. The number of Gen Z customers in China and Asia-Pacific experienced double-digit growth. Meanwhile, comparable store sales in the Americas grew by 2%, fueled by new and returning local customers. In contrast, EMEIA (Europe, the Middle East, India, and Africa) experienced flat sales, as increased local spending was offset by a decline in tourist purchases, particularly within the Middle East.

Analyst Endorsement and Wholesale Sector Insights

Market analysts have responded positively to Burberry's results. Luca Solca, a luxury goods analyst at Bernstein, upgraded Burberry to an “outperform” rating, citing the positive surprise in the quarter's performance. He also pointed out that the results were achieved despite a 3% headwind from the absence of significant markdowns from the previous year. Looking ahead, Burberry anticipates a strong consumer response to its spring 2026 collection, which is expected to further boost sell-through rates. During the earnings call, Schulman, a seasoned retail executive and former president of Bergdorf Goodman, addressed questions regarding the restructuring of Saks and its potential impact on Burberry. He clarified that wholesale operations account for only about 12% of Burberry's business but remain crucial for brand discovery during its ongoing transformation. Schulman expressed confidence in the new leadership of key North American luxury retailers like Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman, envisioning a future where the sector is both smaller and stronger.