As the world's largest cryptocurrency, Bitcoin, continues its relentless ascent, traders are scrambling to position themselves for a potential breakthrough beyond the $80,000 mark. The surge in futures premiums and the growing popularity of the $80,000 call option on the Deribit exchange suggest a strong bullish sentiment among market participants.

Traders Anticipate a Breakout Before Year-End

Bitcoin Breaks $79,500 in Asian Trading

Bitcoin's price has been on a remarkable run, with the digital asset topping $79,500 during the Asian trading session. This latest surge represents a 15% weekly gain, the highest since February, according to CoinDesk data. The rally has been fueled by a sense of optimism following the U.S. election results, which have raised hopes of regulatory clarity for the digital assets industry.Futures Premiums Soar, Indicating Bullish Sentiment

The annualized rolling premium in three-month Bitcoin futures listed on prominent exchanges like Binance and Deribit has surged alongside the price, topping 14% for the first time since June, according to data from Velo. The futures basis on the CME exchange has also risen past 10% on Friday, reflecting a strong bias for bullish bets.This uptick in the futures premium may attract carry traders looking to profit from the price discrepancies between the spot and futures markets. The increased demand for bullish exposure in the derivatives market suggests that traders are anticipating further upside in Bitcoin's price.The $80,000 Call Option Gains Popularity

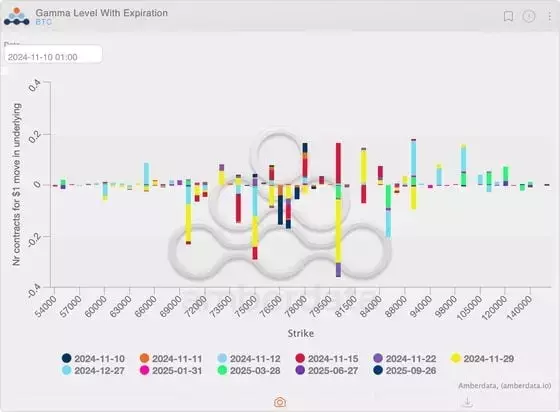

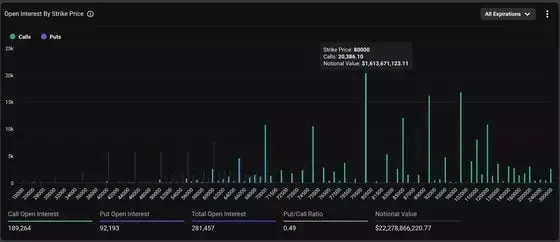

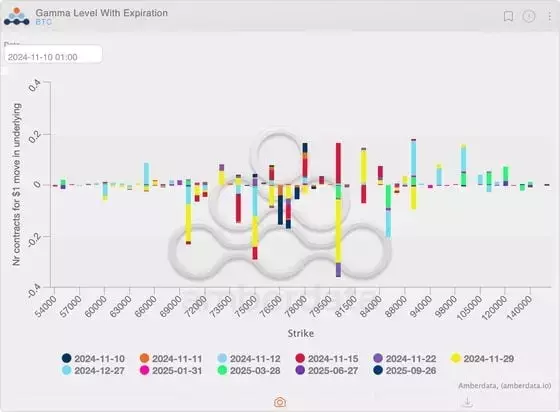

Traders have been piling into the $80,000 strike BTC call option on the Deribit exchange, which offers an asymmetric upside potential to buyers beyond the $80,000 level. The open interest in this call option has increased above $1.6 billion, according to data from Deribit.This concentration of open interest in the $80,000 call option indicates that traders are positioning themselves for a potential breakout above this key psychological level before the end of the year. The data tracked by Amberdata shows that the $80,000 strike has the most negative gamma, meaning that volatility could increase sharply once prices reach that level.Dealer Hedging and Potential Volatility Spike

The negative gamma at the $80,000 strike level suggests that dealers or entities tasked with providing liquidity to order books could be compelled to buy the potential breakout above $80,000, adding to the bullish volatility in the market. This dynamic could further fuel the upward momentum in Bitcoin's price as traders scramble to cover their short positions or add to their long exposure.As the cryptocurrency market continues to evolve, the interplay between the spot and derivatives markets is becoming increasingly important in shaping the overall price dynamics. The current surge in bullish bets and the anticipation of a potential breakout above $80,000 highlight the growing maturity and sophistication of the Bitcoin trading ecosystem.You May Like