In a significant shift within the artificial intelligence hardware market, Broadcom is set to emerge as a dominant player, having secured a massive contract with OpenAI for custom AI processors. This deal is anticipated to bolster Broadcom's revenue streams and market position, potentially allowing it to surpass Nvidia's growth trajectory in 2026. While Nvidia has historically led the GPU market crucial for AI development, the increasing demand for specialized, power-efficient AI chips, particularly ASICs, is creating new opportunities for competitors like Broadcom. This strategic win highlights a growing trend among hyperscalers and AI firms to adopt custom solutions for targeted AI inference tasks, offering cost savings and performance advantages over general-purpose GPUs.

For years, Nvidia has maintained a near-monopoly in the AI data center GPU market, with its graphics processing units being integral to the rapid advancement of AI applications. The company's A100 data center GPUs, for instance, were fundamental to the training of OpenAI's groundbreaking chatbot, ChatGPT, several years ago. Nvidia's first-mover advantage allowed it to command an estimated 92% of the AI data center GPU market by the end of last year, projecting a remarkable 58% increase in its top line to over $206 billion for the current fiscal year. Despite these impressive figures, Broadcom's stock has seen a 48% appreciation this year, outperforming Nvidia's 34% gain, signaling a potential shift in market dynamics.

The landscape of AI chip demand is rapidly evolving, with a noticeable trend towards custom AI accelerators. These application-specific integrated circuits (ASICs) are designed for highly specialized tasks, such as AI inference, offering superior power efficiency and performance compared to general-purpose GPUs. This specialization translates into significant cost savings for large-scale data center operations. OpenAI's decision to procure custom AI accelerators from Broadcom, capable of powering 10 gigawatts of data center capacity, marks a pivotal moment. The deployment of these processors is slated to begin in the latter half of 2026 and conclude by the end of 2029. Given that approximately 60% of data center investment is allocated to chips and computing hardware, this deal alone could represent up to $60 billion in revenue for Broadcom over three years, based on an estimated $6 billion per gigawatt in chip costs.

Broadcom's stronghold in the ASIC market, with an estimated 70% share, positions it ideally to capitalize on this burgeoning demand. Industry forecasts predict a 45% increase in shipments of AI data center ASICs in 2026, significantly outpacing the projected 16% growth for GPUs. This trend, coupled with the OpenAI contract and another $10 billion deal with an undisclosed client, is expected to substantially boost Broadcom's AI revenue. The company had previously anticipated its serviceable addressable market from three AI customers to be between $60 billion and $90 billion. With the addition of the OpenAI deal, this market has expanded considerably, offering greater opportunities for sustained growth and investor returns.

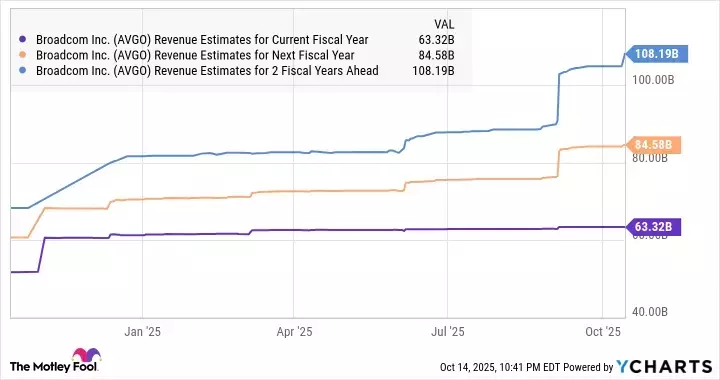

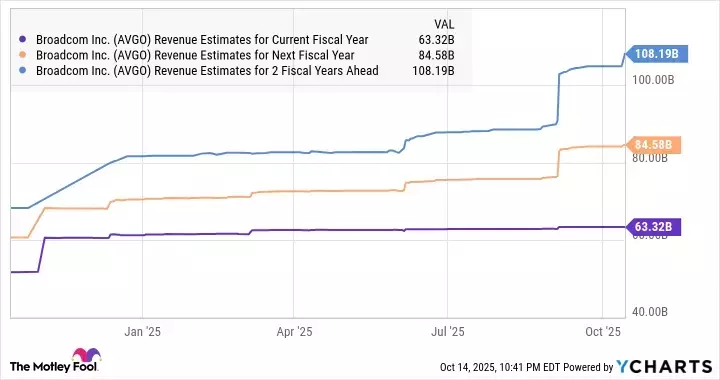

Broadcom is on track to achieve nearly $20 billion in AI revenue for the current fiscal year, a 64% increase from the previous year. The company's record revenue backlog of $110 billion at the end of the fiscal third quarter (August 3rd) is a testament to its growing influence. Analysts currently project a 33% revenue growth for Broadcom next fiscal year, an improvement over the 23% expected in the current year. However, with the monumental OpenAI contract and the broader market shift towards custom AI solutions, there is a strong possibility that Broadcom's actual revenue growth could exceed these expectations, signaling a robust long-term outlook for the company and its investors.