Broadcom has made remarkable strides in the artificial intelligence (AI) sector, with its AI chips for data centers emerging as a strong alternative to Nvidia's offerings. The company's recent financial results underscore this success, showing explosive growth in AI-related sales and outperforming Nvidia's stock performance this year. However, this impressive rally has led to a lofty valuation, raising questions about its immediate investment appeal. The long-term outlook for Broadcom remains positive, especially for investors willing to weather potential short-term volatility.

The burgeoning demand for AI infrastructure, projected to reach trillions of dollars in the coming years, presents a massive opportunity for semiconductor companies. Broadcom is strategically positioned to capture a significant share of this market, leveraging its customizable AI accelerators and advanced networking equipment. While the current high valuation may deter some short-term investors, the company's continued innovation and robust growth trajectory suggest sustained profitability and value creation for dedicated shareholders.

Broadcom's Dominance in AI Hardware

Broadcom's strategic focus on AI hardware, particularly its customizable AI accelerators and state-of-the-art networking equipment, is propelling its growth. Unlike Nvidia's more standardized graphics processing units (GPUs), Broadcom's chips can be tailored to specific data center workloads, offering enhanced flexibility and efficiency for major tech companies. This customizability has attracted significant orders, including a recent $10 billion deal that analysts speculate might be from a leading AI startup like OpenAI. The company's Ethernet switches, crucial for high-speed data transfer within AI data centers, further solidify its competitive edge by ensuring low latency and high throughput. These technological advantages enable faster processing and minimize data loss, which are critical for data-intensive AI operations.

Since its merger with Avago Technologies in 2016, Broadcom has systematically strengthened its market presence through strategic acquisitions, including companies like CA Technologies, Symantec, and VMware. This expansion has diversified its portfolio and reinforced its position as a top-tier hardware provider. The company's AI semiconductor revenue has seen extraordinary year-over-year growth, indicating strong market adoption and an accelerating demand for its products. This strong performance in both custom chips and networking solutions positions Broadcom as a key enabler of the AI revolution, making it an increasingly vital player in the semiconductor industry's future. The consistent increase in large-scale deployments by hyperscale customers, with projections of millions of AI accelerators, underscores the immense market opportunity Broadcom is effectively capitalizing on.

Financial Performance and Future Prospects

Broadcom's financial performance in the fiscal third quarter of 2025 showcased impressive growth, with total revenue exceeding management's forecasts and a significant increase compared to the previous year. A substantial portion of this growth was driven by its AI semiconductor segment, which recorded a record-breaking revenue figure and an accelerating growth rate. This robust performance is expected to continue into the fourth quarter, with management anticipating even higher total revenue and AI semiconductor sales, demonstrating strong momentum in the AI market. Furthermore, the company reported a substantial net income, marking a significant turnaround from a loss in the same period last year, and a healthy increase in adjusted EBITDA, indicating improved operational profitability and cash generation.

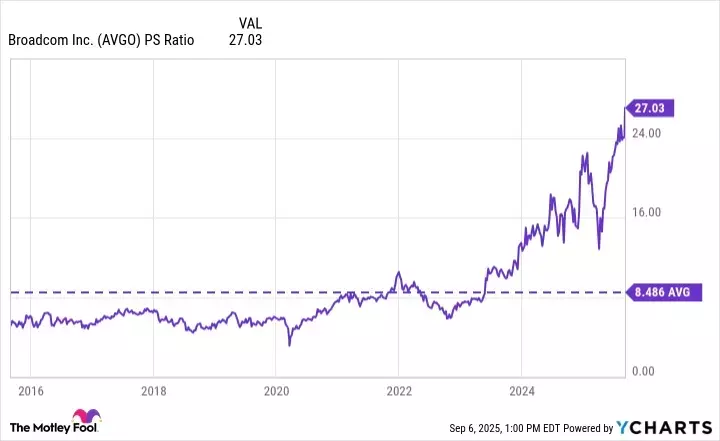

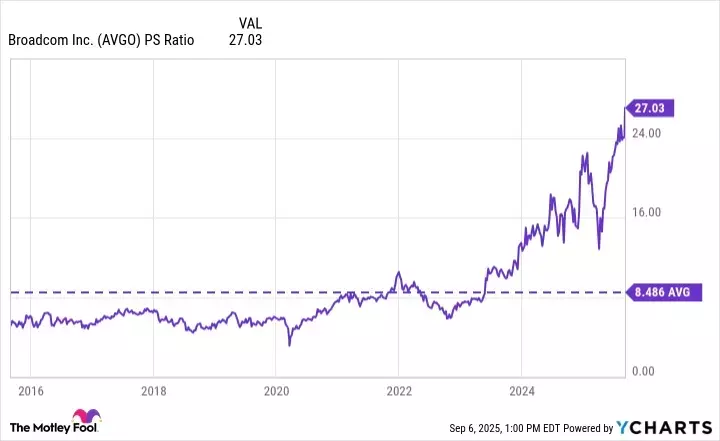

While Broadcom's business fundamentals are exceptionally strong, its stock valuation presents a complex picture for potential investors. The company's price-to-sales (P/S) ratio is at an all-time high, significantly above its historical average, and its price-to-earnings (P/E) ratio is considerably higher than that of its tech industry peers, including the Nasdaq-100 index. This elevated valuation suggests that much of Broadcom's future growth is already priced into the stock, potentially limiting short-term upside. For investors seeking rapid returns within the next year, Broadcom might not be the ideal choice. However, for those with a longer investment horizon of at least five years, the company's sustained AI-fueled growth and strong market position could still translate into positive returns, as the business continues to expand into its current valuation.