Recent analysis by Bank of America's credit strategists highlights the growing financial pressures faced by bond issuers. The study, conducted by Neha Khoda and Adam Vogel, reveals that the substantial increase in outstanding debt and fluctuating interest rates over the past three years have significantly impacted borrowing costs. This effect is particularly pronounced in high-yield bonds compared to investment-grade securities. Loans, while less affected due to their floating-rate structure, still carry elevated refinancing risks for individual issuers. The current credit market stands at an impressive $14.6 trillion, with varying segments showing robust issuance activity. Despite these challenges, financing conditions remain favorable, with record levels of loan repricing observed in 2024.

The research underscores the complexity of the current credit landscape. Over the past three years, changes in interest rates have introduced new challenges for bond issuers. High-yield markets are experiencing more significant impacts than investment-grade counterparts. While loans are less sensitive to interest rate fluctuations, they face higher refinancing risks due to the concentration of near-term maturities, especially among lower-rated entities. This risk is exacerbated by the relatively smaller volume of loans needing refinancing compared to high-yield bonds. However, the proportion of loans maturing soon and the composition of these loans, primarily CCC-rated, heighten the risk for individual issuers.

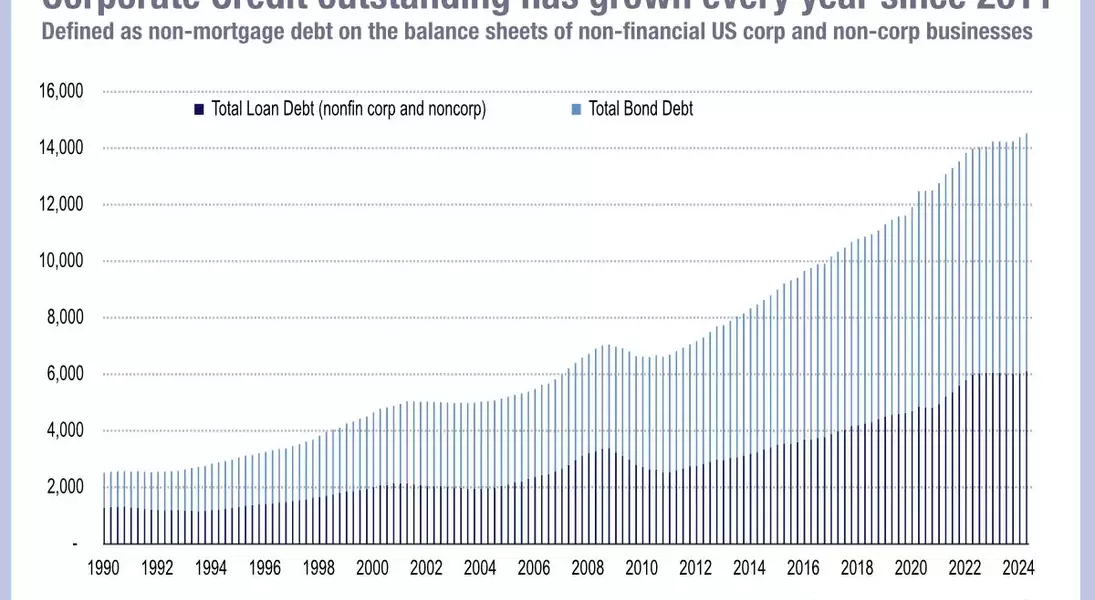

Bank of America's assessment breaks down the $14.6 trillion credit market into several categories: $6 trillion in US investment-grade bonds, $1.2 trillion in US high-yield bonds, $2.8 trillion in investment-grade loans, and $3.3 trillion in below-investment-grade loans, including private credit. The report notes that issuance across all credit categories has remained strong. Investment-grade bonds saw a 25% year-over-year increase in 2024, surpassing $1.5 trillion. High-yield bonds experienced a 60% growth for two consecutive years, reaching nearly $290 billion. Institutional loan issuance surged to $500 billion, marking an 110% increase from the previous year. Additionally, 2024 witnessed a record $760 billion in loan repricing, reflecting the market's voracious appetite for debt.

When evaluating refinancing risks, the bank considered factors such as the proportion of debt coming due and the coupon gap for different market segments. Although investment-grade issuers are expected to bear the brunt of refinancing challenges, they possess stronger balance sheets and lower leverage, which may mitigate some risks. In contrast, high-yield issuers, often characterized by smaller market capitalization and higher leverage, face more severe challenges. A 30% increase in coupon payments could erode one turn of coverage for high-yield issuers, highlighting the elevated refinancing risks within this segment. The historically high proportion of bonds coming due in the high-yield market further compounds these risks on a broader scale.

In light of these findings, the credit market faces both opportunities and challenges. While overall financing conditions remain positive, issuers must navigate the complexities of rising costs and refinancing risks. The resilience of investment-grade issuers provides a buffer against potential downturns, but high-yield and loan markets require careful management to address the heightened risks associated with refinancing and interest rate volatility. The robust issuance activity and record loan repricing underscore the market's dynamism, even as it grapples with these emerging challenges.