The bond market has experienced significant volatility recently, with yields on 10-year Treasury notes fluctuating between 4.56% and 4.8%. This shift reflects a growing belief that the Federal Reserve will adopt a more measured approach to interest rate adjustments this year. Investors are now anticipating only a modest reduction in the overnight policy rate, influenced by persistent inflationary pressures and concerns about the impact of potential changes in trade and spending policies. As the financial landscape adapts to these new conditions, the bond market is seeking a stable equilibrium amid evolving monetary and fiscal strategies.

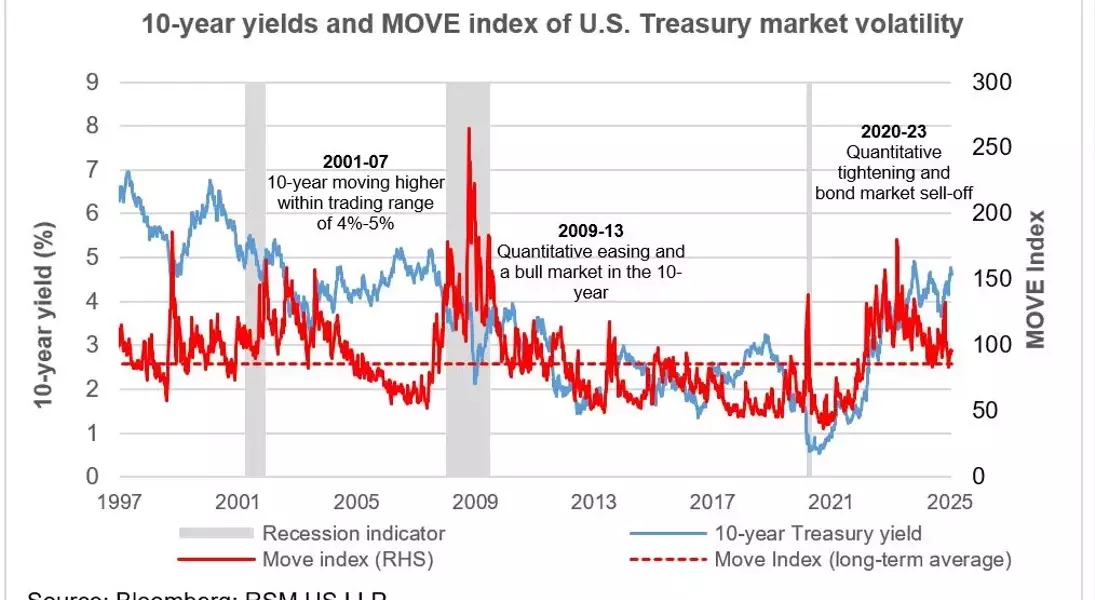

Market analysts have observed that the recent turbulence coincides with the transition from a decade of low-interest-rate environments to a period of normalization. The MOVE index, which gauges volatility in Treasury securities, indicates that the market is recalibrating its expectations for interest rates. With the 10-year Treasury note now hovering around 4.5%, experts predict a trading range between 4% and 5%. This adjustment suggests that bond market volatility may revert to historical averages as economic conditions stabilize.

Furthermore, the Federal Reserve's reliance on data-driven decision-making is facing challenges as economic events unfold faster than anticipated. The central bank must adapt its strategy to account for emerging risks and uncertainties. Fiscal policy changes, in particular, have introduced additional layers of complexity into fixed income markets. To mitigate excessive volatility, the Fed should consider adopting a more forward-looking approach that incorporates broader economic outlooks and potential risks. Such a shift would help stabilize business investment and promote sustainable growth.

In light of these developments, it is clear that the bond market's future trajectory will depend heavily on how effectively policymakers can balance short-term data with long-term strategic considerations. By adjusting their focus, central banks and governments can foster an environment that supports both stability and innovation in financial markets. The coming months will be crucial in determining whether these efforts succeed in reducing market volatility and fostering confidence among investors.