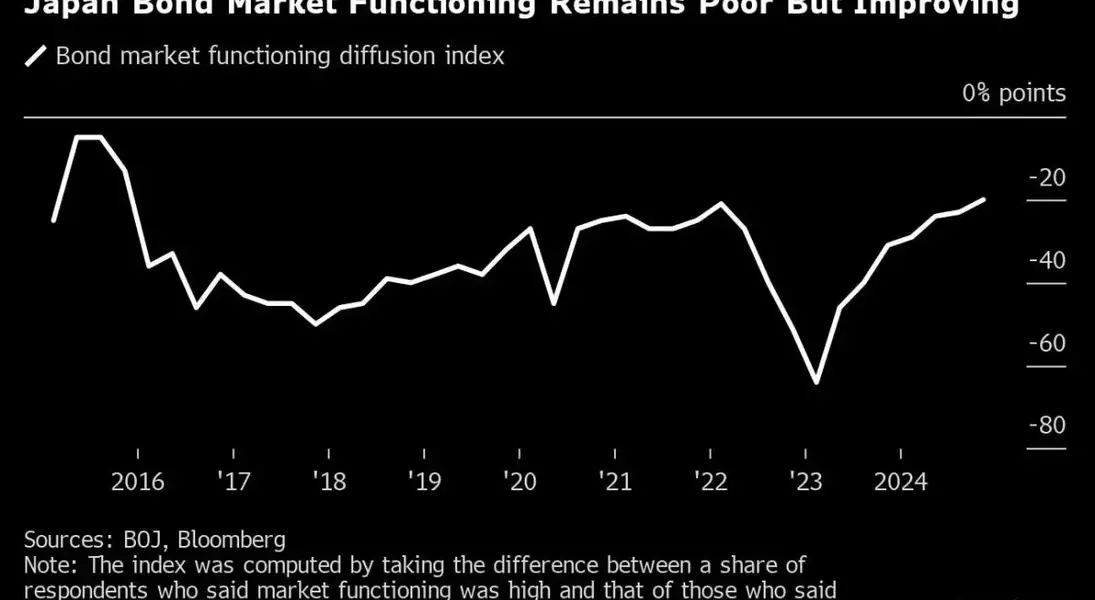

The Bank of Japan has taken a significant step in the financial arena by selling some of its holdings of futures-linked 10-year government bonds. This action is aimed at enhancing the trading liquidity of these securities, which play a crucial role as hedging tools against market volatility. As of November 29, the BOJ owned ¥8.0262 trillion ($53.5 billion) of the bonds due in March 2032, a decrease from ¥8.2262 trillion on November 20. Such data, released late Tuesday, highlights the importance of maintaining liquidity in these bonds, as they serve as the cheapest-to-deliver securities underlying the March contract for 10-year bond futures. The cheapest-to-deliver bonds are those that minimize the seller's cost when converted to the futures contract price.The BOJ regularly employs repurchase agreements to sell government bonds and boost liquidity. In these repo operations, participants have the option to request a reduction in the amount they have to sell back to the central bank. Interestingly, such a reduction occurred for the first time since April 4, 2023, as per the bank's financial markets department.Futures traders frequently turn to the central bank to borrow cheapest-to-deliver bonds to fulfill their transaction obligations or engage in arbitrage trading. For instance, Bloomberg data shows that the BOJ holds over 80% of the four tranches of futures-linked notes maturing in 2031 and 2032.Takashi Fujiwara, the head of fixed income management and chief fund manager at Resona Asset Management Co., believes that the BOJ's sale of the cheapest-to-deliver securities has alleviated concerns among investors who trade futures. They were previously worried about being squeezed due to the scarcity of these bonds. Fujiwara expects the central bank to take similar measures for other futures-linked debt, which will contribute to the improvement of market functioning.The central bank also holds more than half of the government bonds that have not yet matured, which has put a strain on liquidity in the market. The BOJ's latest survey of market participants revealed that most respondents felt the need for improvement in bond market parameters such as bid-ask spreads, order quantity, and trading frequency.Given that Japan's inflation remains above the BOJ's target of 2%, the central bank has a well-defined roadmap to reduce its monthly bond purchases by approximately ¥400 billion every quarter until March 2026.In conclusion, the Bank of Japan's actions regarding 10-year government bond trading liquidity have significant implications for the financial market and are closely watched by investors and market participants alike.