Unraveling the Impact of US Semiconductor Policies on Markets

US vs. Global Market Contrast

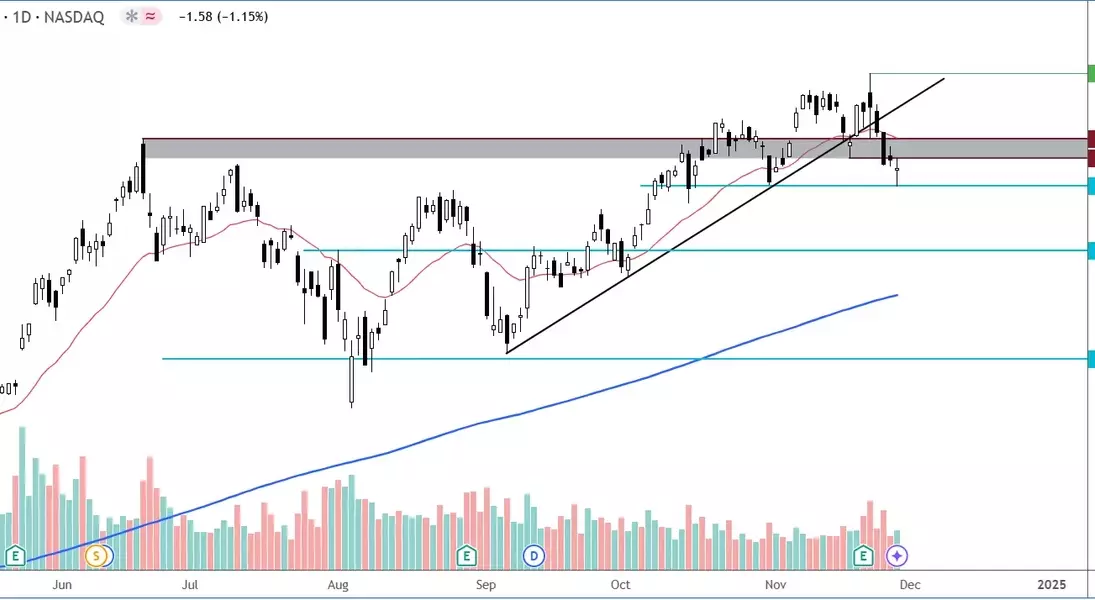

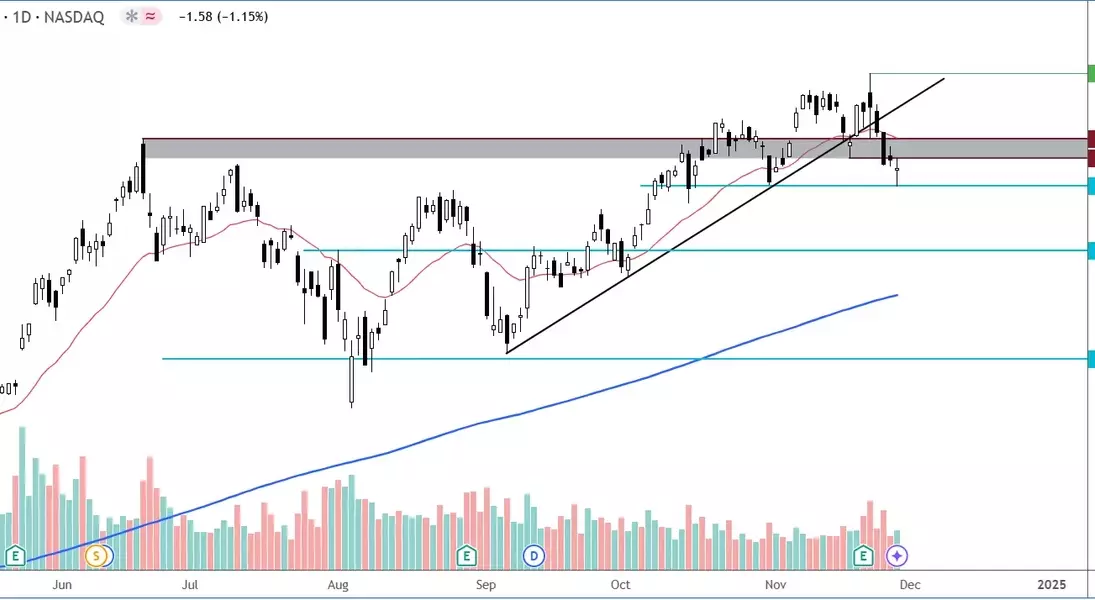

This year, the disparity between US markets and the rest of the world, especially China, has been quite remarkable. US investors anticipate a business-friendly president to drive growth in 2025, while trade tariffs and protectionist policies pose headwinds for Chinese markets and, to a lesser extent, the Eurozone. The "Trump trade" has largely been factored in, making it challenging for US markets to achieve substantial further gains. However, without a clear technical reversal pattern on the charts, it's premature to act on a cautious outlook.Indeed, the technical picture on the Nasdaq remains bullish for now, despite a slight loss of momentum in recent days. As long as we don't see a breakdown in the market structure of higher highs and higher lows, it's futile to try to go against the trend.

We can prepare for a potential market reversal in case some risk-off stimulus comes into play. I'll also highlight some bullish targets in case the rally continues.

Key Support and Resistance Levels

The key area of support was tested on Wednesday and was being tested again at around 20,800 on the Nasdaq futures chart when writing. This is where the 21-day exponential moving average converges with the bullish trend line that has been in place since markets bottomed in August. As a minimum, the bears would need to see the breakdown of this trend line on a daily closing basis before turning bearish.The next level of support below this area is around 20,385, a level that has already been tested and is where the post-election rally began. If the market were to go below this area, it would be a psychological blow for the bulls who bought on the assumption that Trump's policies would boost the stock markets. The line in the sand for me is at 20,020.

This level is a crucial zone where the market has found both resistance and support on multiple occasions. It is also the low made prior to the election-related rally. A breakdown below this level would create a lower low and confirm that the market may have formed at least a temporary peak.

In terms of key resistance levels, the July high comes in at 20,983. We broke above this level after the US presidential election but couldn't hold it, leading to a sharp sell-off on Friday November 15. During much of last week and early this week, the market stabilized and recovered some of the losses since peaking earlier this month. However, without a decisive break above the July high, a higher degree of caution is warranted.If the bulls recapture the July high, it could initiate another move higher. Above that, there's nothing significant until the all-time high of 21,340, and then it's uncharted territory. An extended bullish target is at 21,971, marking the 127.2% Fibonacci extension level of the July drop.

Individual Stocks to Watch

Among individual names to watch when cash markets reopen on Friday is NVIDIA Corporation (NASDAQ:NVDA). The chipmaker closed below the breakout area of 140 after reaching 150. The break of the short-term bullish trend line and 21-day exponential moving average is another cause for concern for the bulls. This could potentially add pressure on the tech-heavy Nasdaq 100.As always, it's all about follow-through. Every time there's a downward move, the dip is quickly bought. So, we'll see if more selling resumes on Friday before jumping to any conclusions.

Disclaimer: This article is for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest. Any investment decision and associated risk remain with the investor. Read my articles at City Index.