Bitnomial, a regulated digital asset derivatives exchange, is seeking regulatory approval to offer perpetual futures trading in the US, while EDXM Global plans to launch a similar venue in Tokyo. The exchange is working to establish a compliant derivatives market for digital assets, leveraging Ripple's RLUSD stablecoin for settlement. As the crypto industry continues to evolve, Bitnomial and its peers are paving the way for institutional investors to access this emerging asset class through regulated and secure trading platforms.

Unlocking the Potential of Crypto Derivatives Trading

Bitnomial's Regulated Approach to Crypto Futures and Options

Bitnomial, a digital asset derivatives exchange founded in 2014, is poised to become the first regulated platform in the US to offer perpetual futures trading. The exchange is regulated by the Commodity Futures Trading Commission (CFTC) and operates a CFTC-regulated clearinghouse and brokerage subsidiaries, providing institutional traders and native digital asset hedgers with a secure and compliant trading environment.Bitnomial's upcoming Botanical platform will allow traders to speculate on the prices of cryptocurrencies indefinitely through perpetual futures contracts. These contracts, which do not have an expiry date, offer a trading experience similar to that of decentralized finance (DeFi) platforms, but with the added layer of regulatory oversight and institutional-grade infrastructure.To ensure the smooth launch of Botanical, Bitnomial must navigate a complex regulatory landscape. The CFTC will need to be satisfied with the pricing and clearing structure, as well as the risk profile of the new contracts, before granting approval. Michael Dunn, the president of Bitnomial Exchange, acknowledges the challenges, stating, "We have to go through a lot of regulatory hurdles but will be working day and night to get it over the line."Expanding the Crypto Derivatives Ecosystem

Bitnomial's efforts to bring regulated crypto derivatives trading to the US market are part of a broader trend in the industry. Following the US presidential election, there is a renewed sense of optimism around digital asset regulation, with the potential for more comprehensive frameworks to emerge.In addition to perpetual futures, Bitnomial has already received regulatory approval to list bitcoin hashrate futures, which allow market participants to hedge their exposure to the bitcoin mining industry. The exchange has also expressed interest in launching futures and options contracts for other digital assets, such as XRP, as long as they are deemed not to be securities.Bitnomial's focus on physically settled crypto derivatives, as opposed to cash-settled products, is a key differentiator. The exchange believes that this approach better reflects the underlying supply and demand dynamics of the digital asset markets, providing a more accurate representation of their true value.Driving Sustainability in the Crypto Mining Sector

Bitnomial's vision extends beyond just offering crypto derivatives trading. The exchange is also exploring the integration of electricity hedging contracts, which would allow bitcoin miners to manage their price risk, hashrate risk, and network competition risk more effectively.By enabling miners to hedge their exposure through a suite of regulated contracts, Bitnomial aims to make the mining business more sustainable and resilient. This, in turn, could have a positive impact on the broader crypto ecosystem, as a more stable mining industry can contribute to the overall health and reliability of the networks.Dunn believes that the ability to portfolio-margin these various contracts will be a "massive" competitive advantage as bitcoin markets continue to scale. Additionally, he hopes that regulators will eventually authorize the use of digital assets as collateral, further enhancing the efficiency and accessibility of the crypto derivatives market.Bitnomial's Growth Trajectory

Bitnomial's efforts to establish a regulated crypto derivatives market in the US are already bearing fruit. The exchange reported a 53% quarter-over-quarter increase in trading volume, reaching over $79 million in the first half of 2022. Open interest also grew to nearly $14 million, indicating strong demand for physically settled crypto futures and options.The exchange attributes this growth to factors such as basis trading, the approval of spot digital asset ETFs, and the bitcoin halving event in April 2022. Dunn is optimistic about the exchange's future, stating, "Building upon the significant clearinghouse approval granted by the CFTC at the end of last year, we anticipate exponential growth on our platform as we begin to bring new products to the market and execute our vision for fundamentally upgrading US-based digital asset derivatives trading globally."Emerging Competition in the Crypto Derivatives Space

Bitnomial is not the only player vying for a share of the regulated crypto derivatives market. EDXM Global, a part of the EDX family of digital asset technology companies, has announced plans to launch a perpetual futures venue in Tokyo, slated for the first quarter of 2025.EDXM's new venue will enable secure, efficient, and low-risk trading for perpetual futures contracts in bitcoin and ether. The company has already launched a Singapore-based settlement service and recently unveiled its proprietary New Matching Engine (NME), which boasts ultra-low latencies measured in microseconds.EDXM's efforts to expand its footprint in the crypto derivatives space are reflected in its impressive trading volumes. In the third quarter of 2022, the company reported a 59% increase in average daily volumes, with over $36 billion in notional volume matched since January 2024.As the crypto derivatives market continues to evolve, Bitnomial, EDXM, and other players in the space will likely engage in a race to offer the most innovative, secure, and compliant trading solutions to institutional and retail investors alike.Institutional Investors Embrace Crypto Allocations

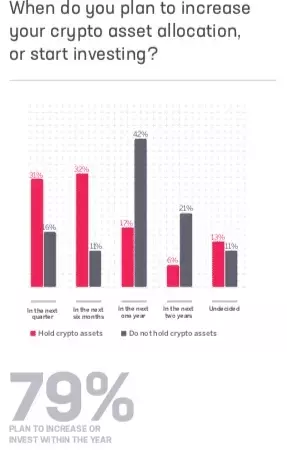

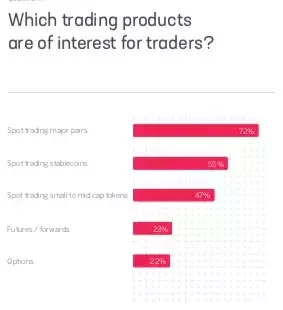

The growing interest in crypto derivatives trading is mirrored by the broader institutional adoption of digital assets. According to a survey conducted by Sygnum, the regulated Swiss digital asset banking group, more than half of institutional and professional investors active in the crypto market plan to increase their allocations.The survey, which polled over 400 market participants from 27 countries, found that one-third of investors with existing crypto holdings intend to increase their allocations in the fourth quarter of 2022, and another third plan to do so within the next six months.However, the survey also revealed a more conservative approach to complex derivatives products, with only 23% of respondents expressing interest in trading futures/forwards and 22% in options. This suggests that while institutional investors are increasingly embracing crypto, they may still be cautious about venturing into the more sophisticated corners of the market.Nonetheless, the survey also highlighted growing interest in tokenization, with one-third of investors indicating their interest in this emerging trend. As leading traditional finance institutions launch their own tokenization platforms and products, and supportive regulation around the tokenization of real-world assets emerges, this interest is likely to continue rising.