Recent market movements have drawn considerable attention to Strategy, a significant participant in the cryptocurrency sphere, as Bitcoin experiences a period of heightened volatility.

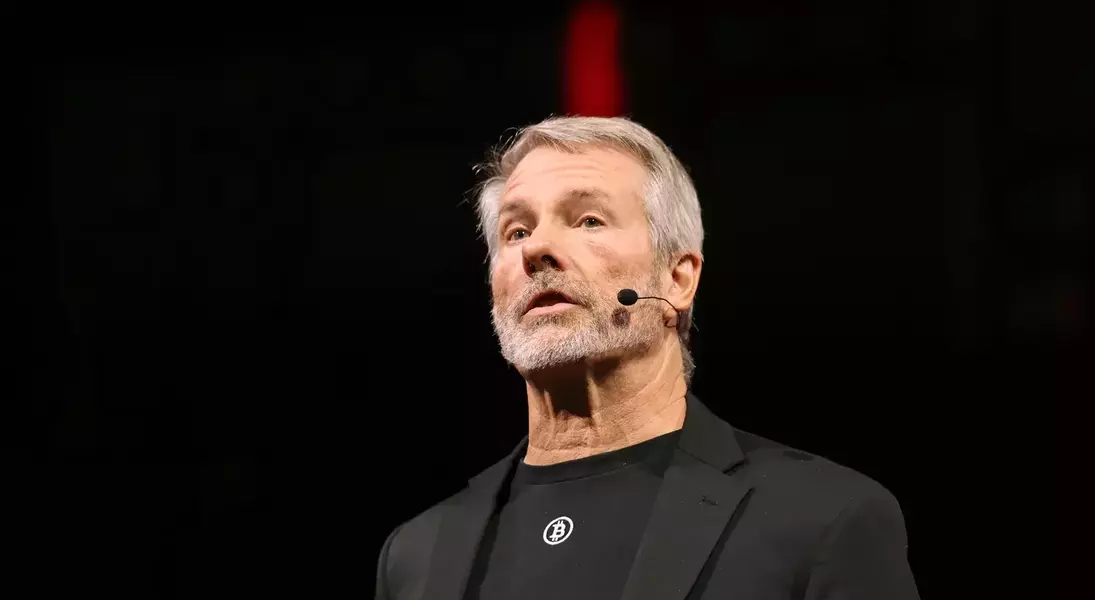

Strategy, a prominent publicly traded company with substantial Bitcoin holdings, finds itself under scrutiny as the digital currency's price approaches its average acquisition cost. The executive chairman, Michael Saylor, a vocal proponent of Bitcoin, is facing increased pressure from market analysts and investors. This period of instability is not limited to Bitcoin alone; other crypto-related stocks, including Coinbase and BitMine Immersion Technologies, are also experiencing declines, reflecting broader unease within the digital asset market.

The downturn in cryptocurrency values has prompted discussions among experts regarding Bitcoin's potential trajectory. While some believe the asset may be entering a "value zone" that could attract new investments, others, like John Blank of Zack's, foresee further price reductions, possibly dropping to as low as $40,000. This uncertainty underscores the inherent risks and speculative nature of the cryptocurrency market, particularly for large-scale investors like Strategy, whose financial health is closely tied to Bitcoin's performance.

The dynamic and often unpredictable nature of the cryptocurrency market demands vigilance and strategic foresight from all participants. While fluctuations are inherent in emerging asset classes, a long-term perspective, coupled with robust risk management, is crucial for navigating these evolving financial landscapes. Embracing innovation responsibly can lead to transformative opportunities, but it also necessitates a clear understanding of potential challenges.