Unraveling the Bitcoin Futures Frenzy: A Cautionary Tale of Market Dynamics

The recent Bitcoin price drop has been attributed to a surge in futures trading activity, with a "long squeeze" in the perpetual futures market being the primary driver. This market dynamic has led to a wave of liquidations, exacerbating the downward pressure on the cryptocurrency. However, the broader macroeconomic landscape, including the potential for further interest rate hikes by the Bank of Japan, has also contributed to the heightened volatility in the Bitcoin market.Navigating the Turbulent Tides of Cryptocurrency Futures

The Long Squeeze Phenomenon

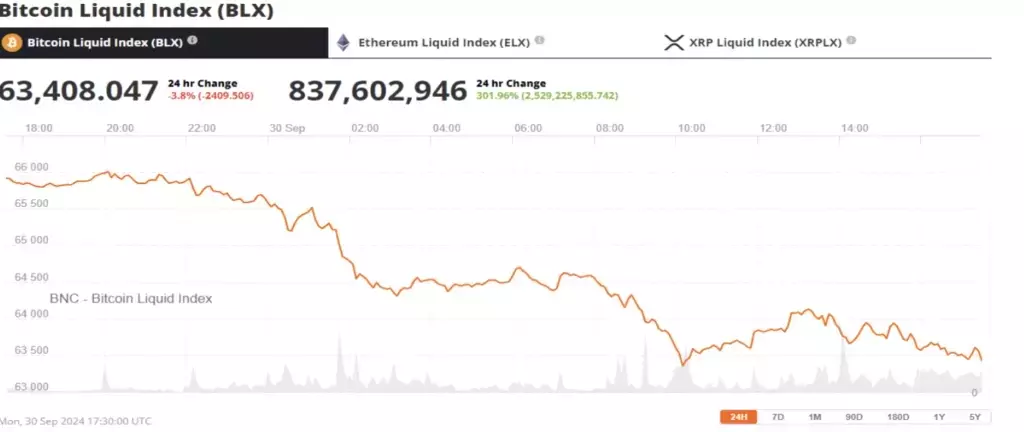

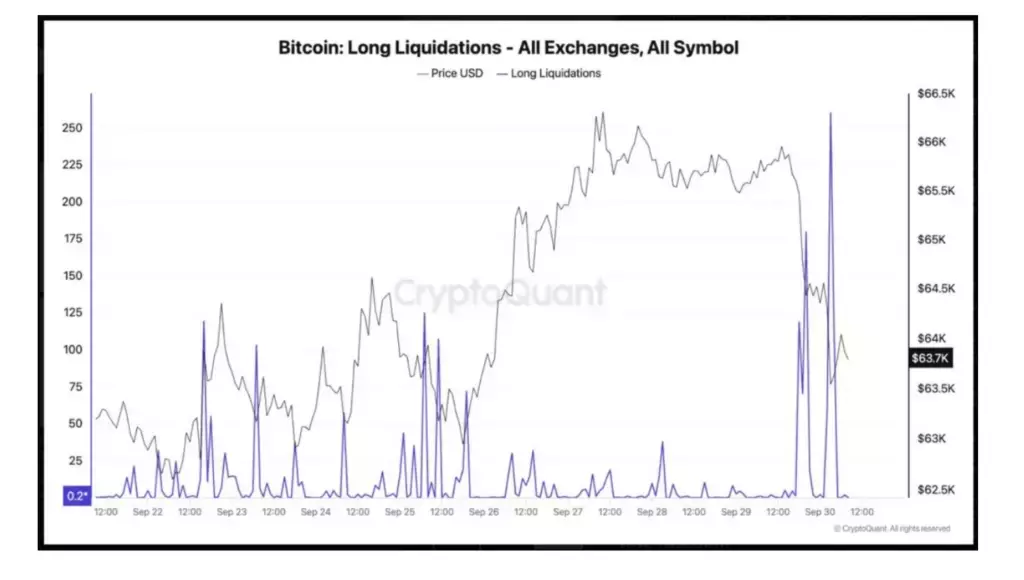

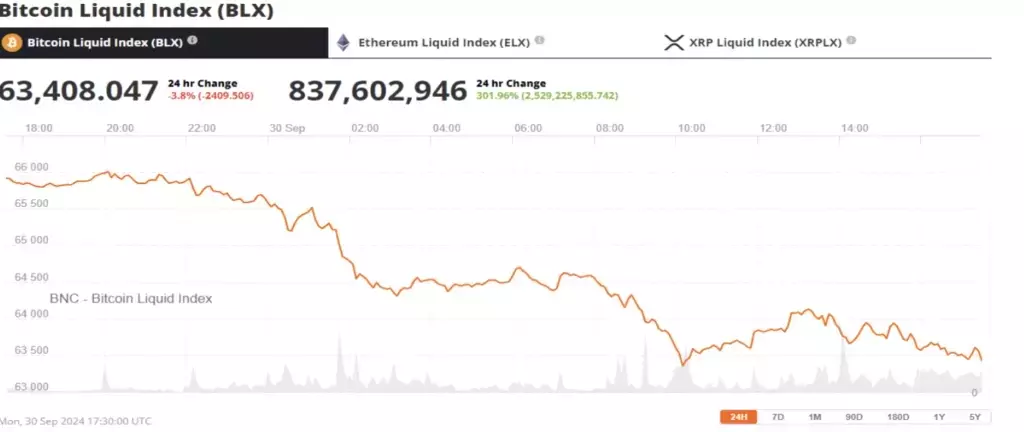

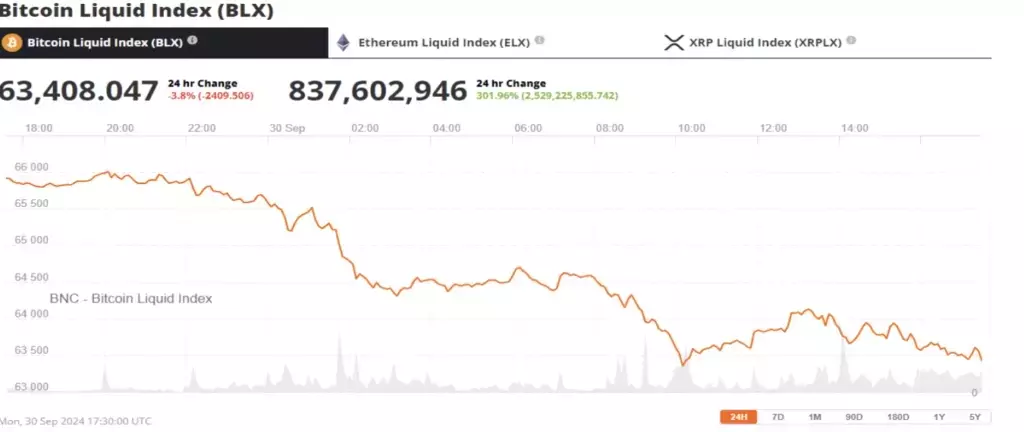

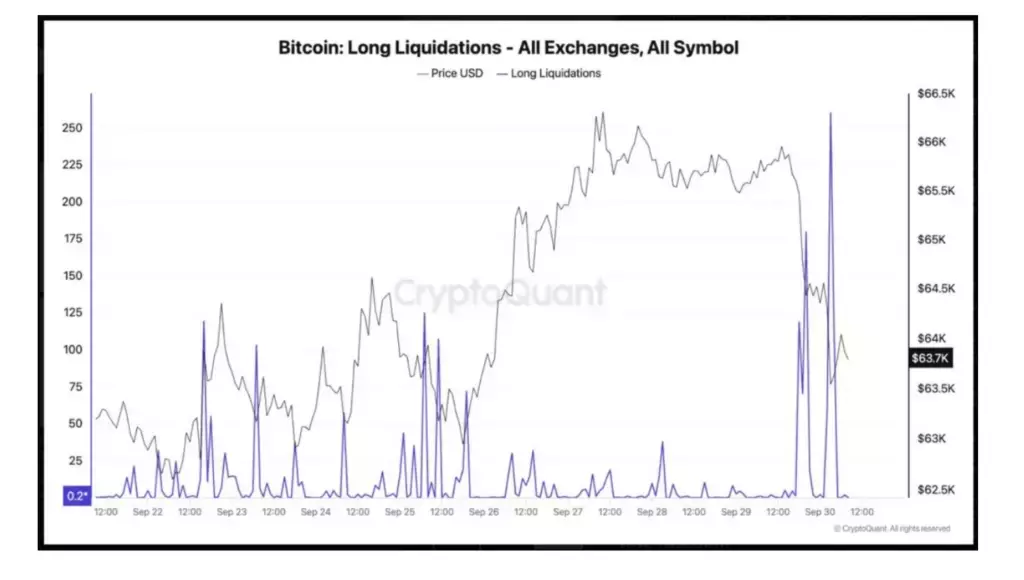

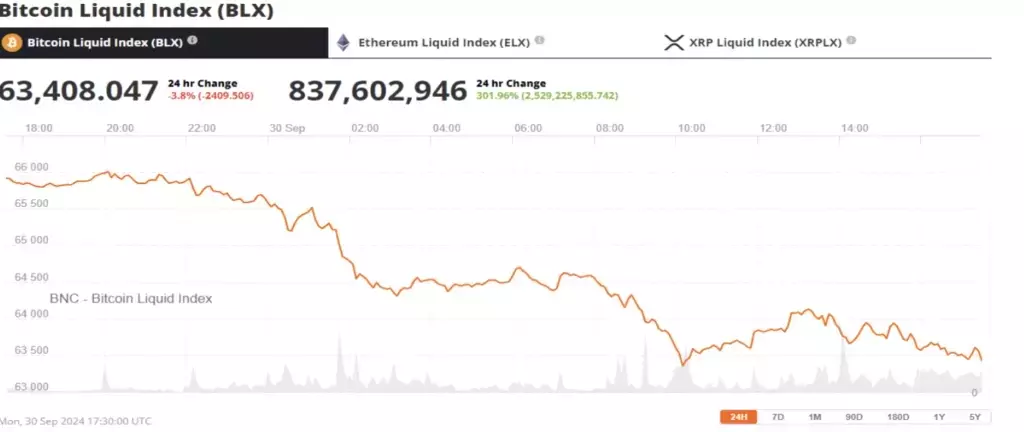

The Bitcoin market has experienced a significant price drop, with the cryptocurrency losing over 3.40% in the past 24 hours. This decline has been attributed to a "long squeeze" in the perpetual futures market, as revealed by the Brave New Coin's Bitcoin Liquid Index. At the time of writing, Bitcoin is trading at $63,408, marking a slight 0.30% gain in the last week.The long squeeze occurs when the price of an asset declines, forcing traders with leveraged long positions to either sell or face liquidation to meet margin requirements. This intensified selling pressure can further drive down prices, triggering additional margin calls and forced liquidations, amplifying the downward momentum. In the past 24 hours, a total of 67,689 traders have been liquidated, resulting in total liquidations across centralized exchanges amounting to $188.38 million, according to data from Coinglass.The Futures Market's Influence on Bitcoin Prices

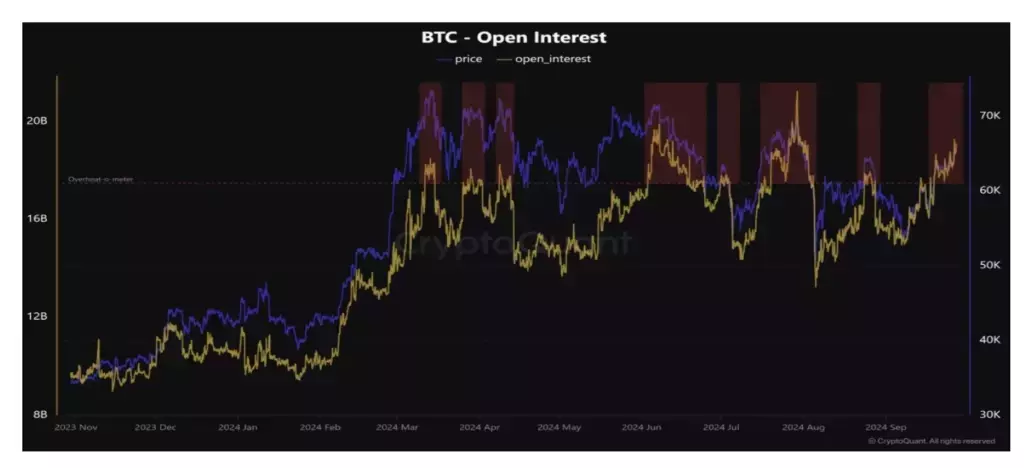

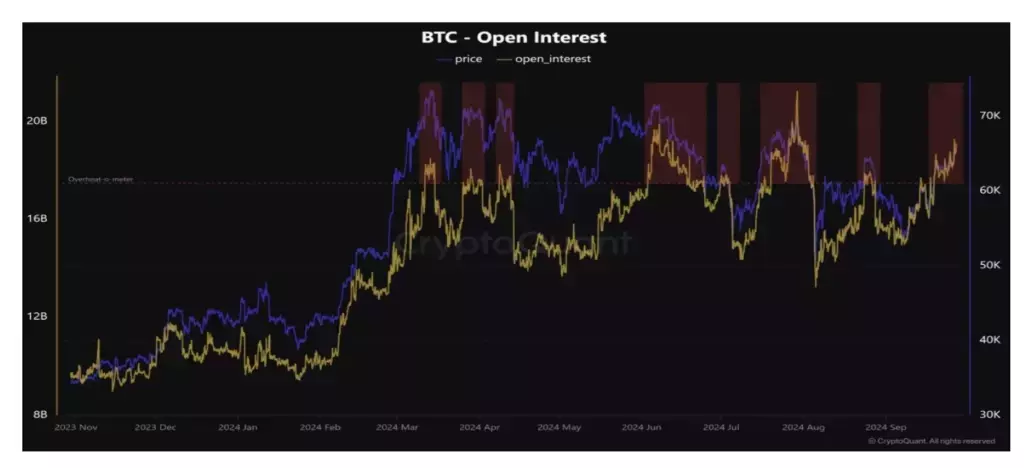

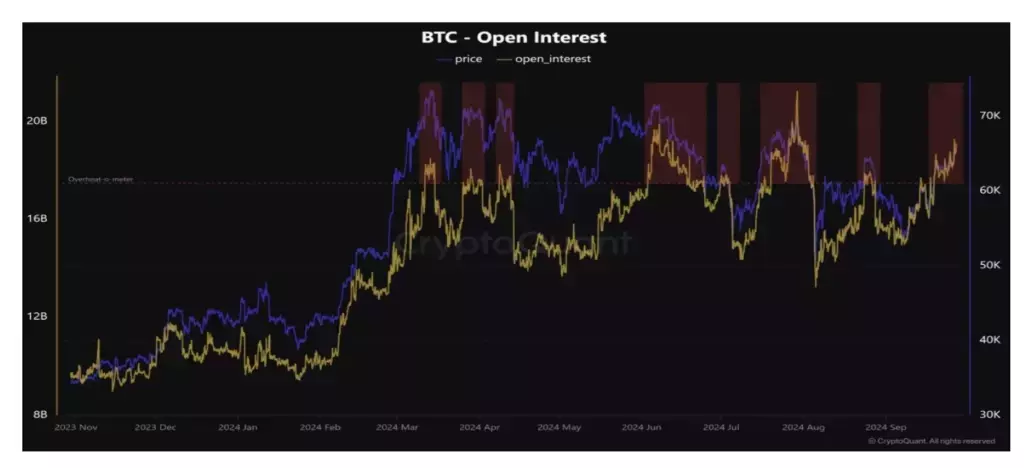

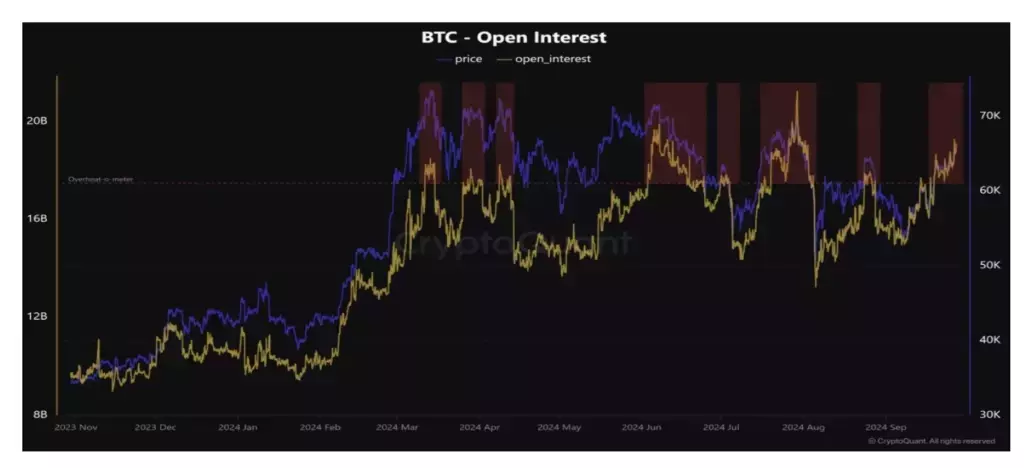

The Bitcoin-led cryptocurrency market has been particularly susceptible to these liquidations, with nearly $48.49 million wiped out during this period. Notably, over $40 million of these Bitcoin liquidations were attributed to long positions, highlighting the significant impact of the long squeeze on bullish traders.The futures market's influence on Bitcoin prices has been a subject of increasing concern. CryptoQuant analysts have pointed out that the open interest—the total value of outstanding contracts—has reached approximately $19.1 billion, a level that has historically been followed by price declines. Since March 2024, open interest has exceeded $18.0 billion only six times, and each instance has resulted in a price drop, with the current situation marking the seventh occurrence.Macroeconomic Factors Fueling Volatility

The macroeconomic environment is also contributing to the current market dynamics. The anticipation of possible future interest rate hikes by the Bank of Japan (BoJ) has instilled caution in global stock markets, dampening the recent optimism that had emerged following China's latest economic stimulus measures and the U.S. Federal Reserve's rate cut on September 18.Investors are particularly wary of a repeat of the yen carry trade unwind that occurred in late July, which caused panic in financial markets and led to Bitcoin's rapid plunge from $70,000 to below $50,000 within days. The yen carry trade involves borrowing yen at low-interest rates to invest in higher-yielding assets, and its unwinding can have significant market repercussions.The appointment of Shigeru Ishiba as the next prime minister of Japan has led to a renewed appreciation of the yen, but Japan's Nikkei 225 Index dropped 4.8%, marking its sharpest decline in eight weeks. This downturn in the Japanese stock market has had a ripple effect on global equities, contributing to increased market volatility.The Interconnectedness of Crypto and Traditional Markets

The contrasting movements in global markets underscore the interconnectedness of economic policies and investor sentiment. While China's aggressive stimulus has boosted its stock market, concerns over tightening monetary policies in Japan and potential impacts on currency valuations are causing jitters elsewhere.In the cryptocurrency market, the heightened volatility serves as a reminder of the influence of macroeconomic factors. The combination of leveraged positions in the futures market and global economic uncertainties is creating a perfect storm for Bitcoin volatility, as noted by a market analyst.Looking ahead, traders and investors will be closely monitoring central bank policies and their implications for both traditional and digital assets. The recurring pattern of high open interest leading to price declines suggests caution may be warranted when the futures market overheats.As central banks navigate the delicate balance between stimulating growth and controlling inflation, their decisions will likely have far-reaching effects on the cryptocurrency market. The current price trajectory of Bitcoin is a convergence of factors, including market sentiment, futures market dynamics, and macroeconomic policies, and it remains to be seen whether this marks the beginning of a sustained downturn or a temporary correction.