Unraveling Bitcoin's Surge and Market Dynamics

Dec. 4 - Trump's Crypto Advocate Selection

On Dec. 4, it was reported that President-elect Donald Trump chose former Securities and Exchange Commissioner Paul Atkins, a prominent advocate for cryptocurrencies. This selection sent a positive signal to the market, boosting traders' sentiment and potentially contributing to Bitcoin's ascent. The influence of such high-profile figures in the cryptocurrency space cannot be underestimated, as it can sway market perceptions and drive investor interest.Moreover, the fact that a respected figure like Paul Atkins is now associated with the regulation of cryptocurrencies gives them a certain level of legitimacy in the eyes of many. This, in turn, can attract more institutional investors and mainstream attention to the Bitcoin market.

It shows that even at the highest levels of government, there is an emerging recognition of the importance and potential of cryptocurrencies. This development has the potential to shape the future of the Bitcoin market and its integration into the global financial system.

Dec. 4 - Putin's Praise for Bitcoin

On the same day, Russian President Vladimir Putin lauded Bitcoin's censorship-resistant features, emphasizing that this new technology is "inevitable." His words carried significant weight and added to the positive sentiment surrounding Bitcoin.Putin's recognition of Bitcoin's unique qualities highlights the global appeal and potential of the cryptocurrency. It shows that Bitcoin is not just a niche asset but has gained recognition on the international stage.

This endorsement from a major world leader can have a ripple effect, influencing other countries and institutions to take a closer look at Bitcoin and its role in the future of finance. It further solidifies Bitcoin's position as a disruptive force in the traditional financial system.

Dec. 4 - Powell's Bitcoin Remarks

US Federal Reserve Chair Jerome Powell stated that Bitcoin is a direct competitor to gold, despite being a speculative asset. This comment sparked discussions and raised questions about Bitcoin's place in the global financial landscape.Powell's acknowledgment of Bitcoin's competitiveness with gold indicates that the cryptocurrency is no longer being ignored by mainstream financial institutions. It shows that Bitcoin is being taken seriously as a viable alternative to traditional assets.

However, it also highlights the need for proper regulation and oversight to ensure the stability and integrity of the Bitcoin market. As Bitcoin continues to gain traction, it is crucial for regulators to strike a balance between promoting innovation and protecting investors.

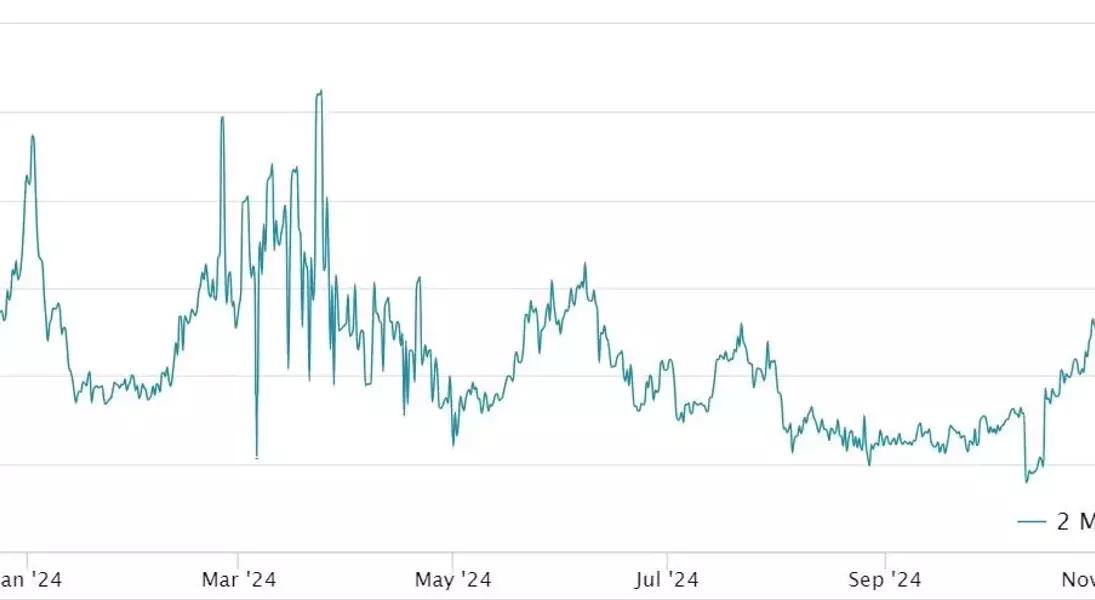

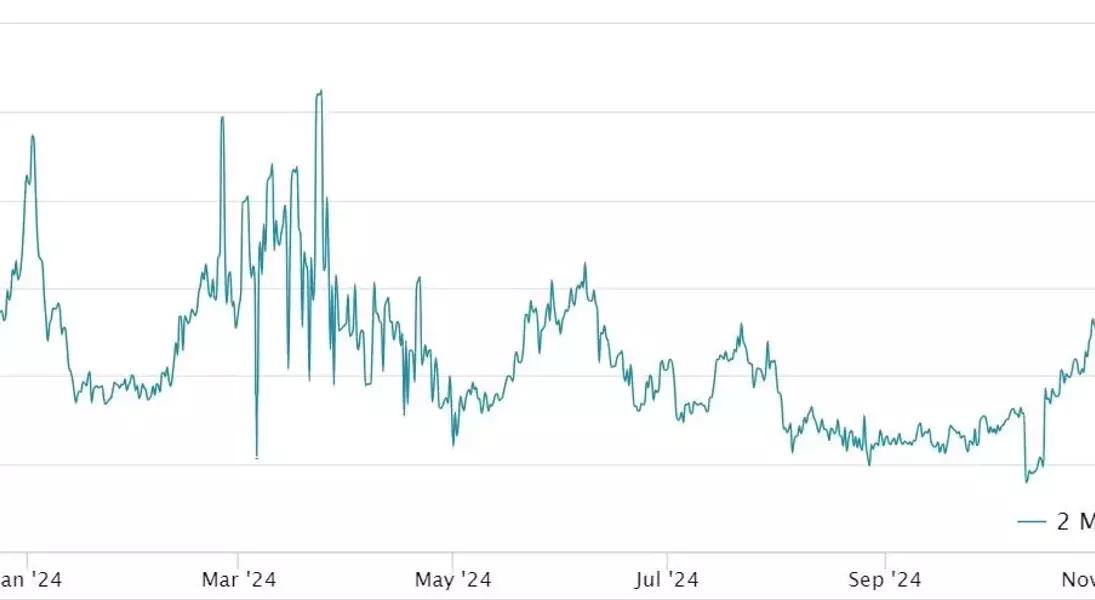

Spot ETF Market and MicroStrategy's Impact

Even for those who have reservations about Bitcoin as a store of value due to its volatility, its $107 billion spot exchange-traded fund (ETF) market is too substantial to ignore. MicroStrategy, a publicly traded company that has been issuing shares and debt to acquire Bitcoin, is expected to join the Nasdaq-100 index in 2025.MicroStrategy's potential inclusion in the Nasdaq-100 index is highly significant for Bitcoin's price. It allows passive funds that track the index to allocate capital to MSTR shares, indirectly increasing exposure to Bitcoin holdings and driving demand.

This connection between a major company and the Bitcoin market demonstrates the growing influence of cryptocurrencies in the traditional financial world. It shows that Bitcoin is no longer just a speculative asset but is being integrated into institutional portfolios.

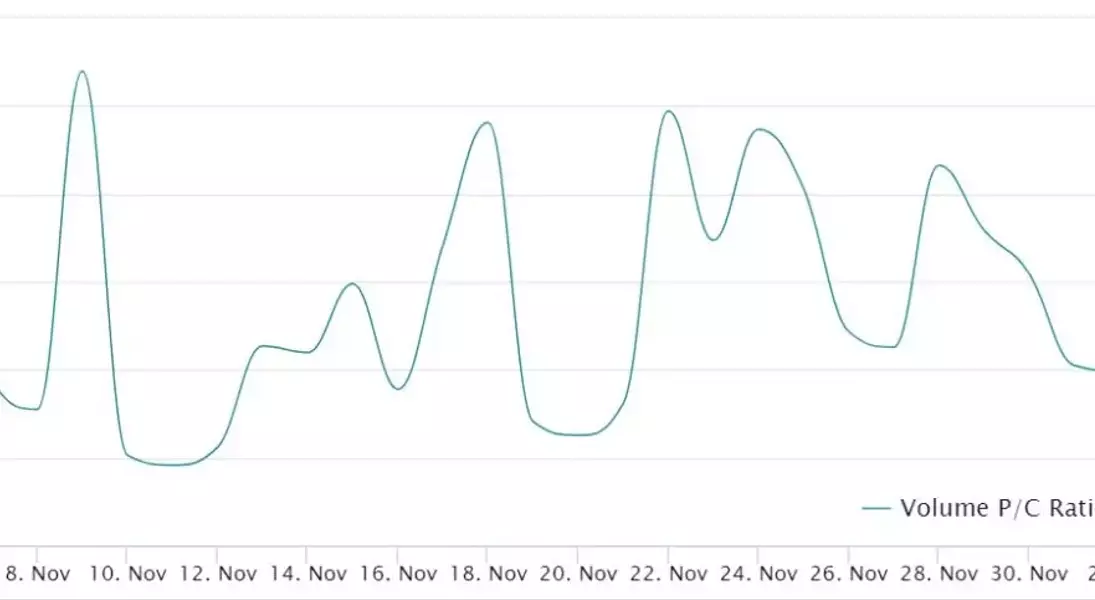

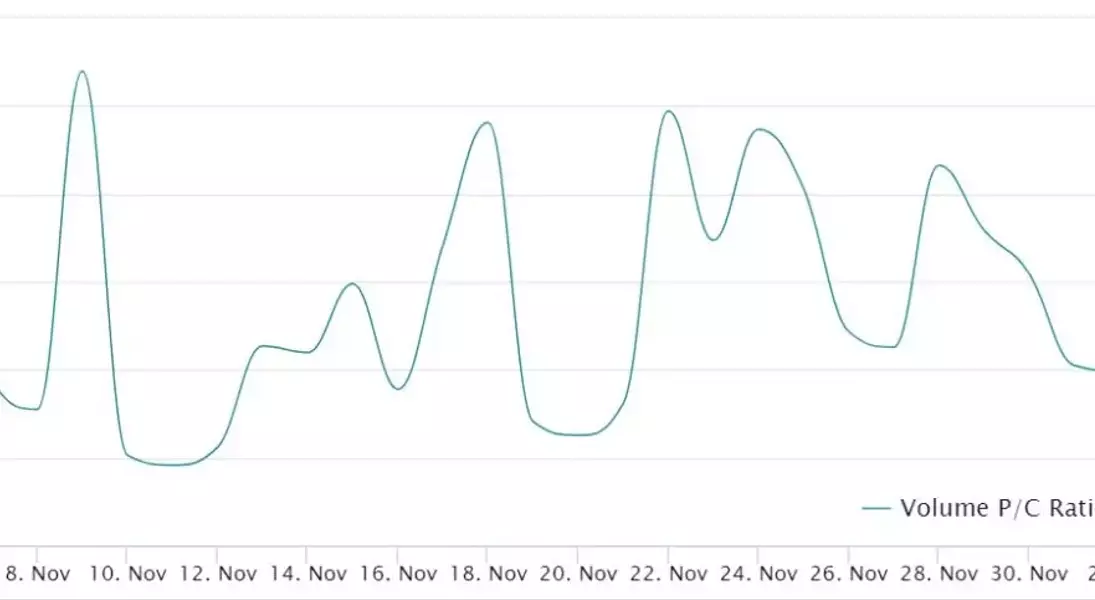

Options Market and Market Sentiment

To determine whether professional traders are overly confident, one must analyze the Bitcoin options markets. Since Dec. 2, open interest in put options at Deribit has lagged behind call options by 48%, similar to previous weeks.This data indicates that derivatives markets were not the driving force behind Bitcoin's rally above $100,000. Instead, it suggests that traders remain confident in the potential for further upside in the Bitcoin market.

The relatively low demand for put options implies that traders are not expecting a significant decline in Bitcoin's price. This confidence is likely driven by various factors, such as the positive developments mentioned earlier and the overall bullish sentiment in the market.

External Factors and Bitcoin's Short-Term Trajectory

Bitcoin is not immune to external factors, and investors are concerned about the global economy potentially entering a standstill. Even without a real estate market collapse or a tech bubble burst, the stock market's valuation poses a risk if earnings stagnate.Historically, when fear grips the market, investors tend to sell off their recent winners, which could have a negative impact on Bitcoin's price. This highlights the need for Bitcoin to establish its own independent footing and not be overly reliant on traditional financial markets.

However, despite these external risks, Bitcoin has shown resilience and the ability to attract investors even in uncertain times. Its unique characteristics and potential as a store of value continue to attract attention from both retail and institutional investors.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author's alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.