Benjamin Njiri, a renowned journalist, brings you the latest insights on the Bitcoin [BTC] market. In this article, we explore how the BTC Futures market has ebbed while the spot market remains dominant, and what this means for the future of Bitcoin.

Unraveling the Bitcoin Futures-Spot Market Dilemma

Bitcoin Futures Market: A Slowdown Amid Strong Spot Demand

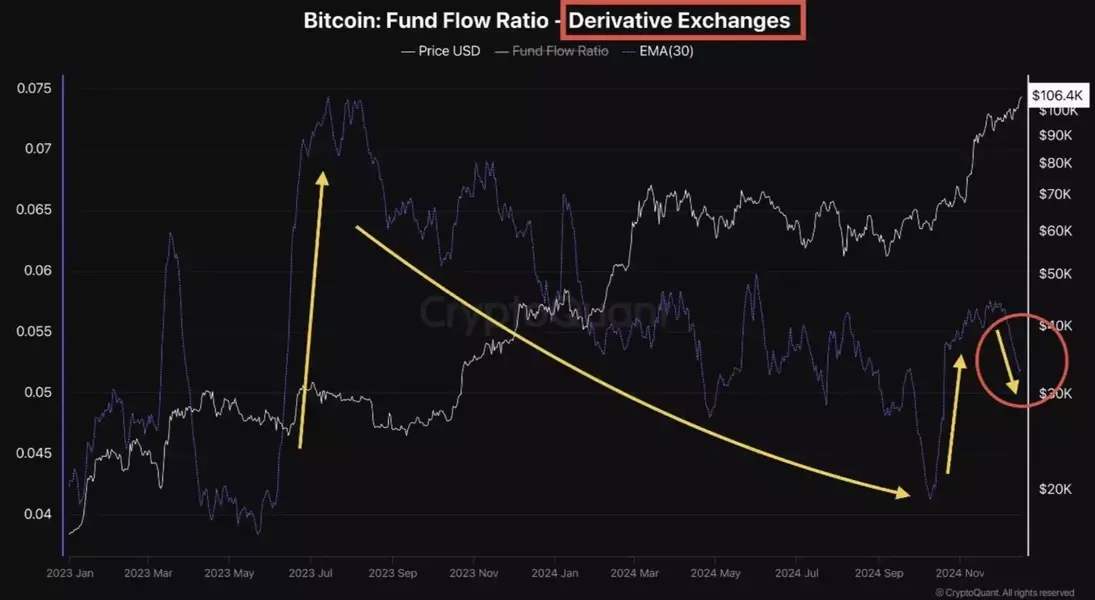

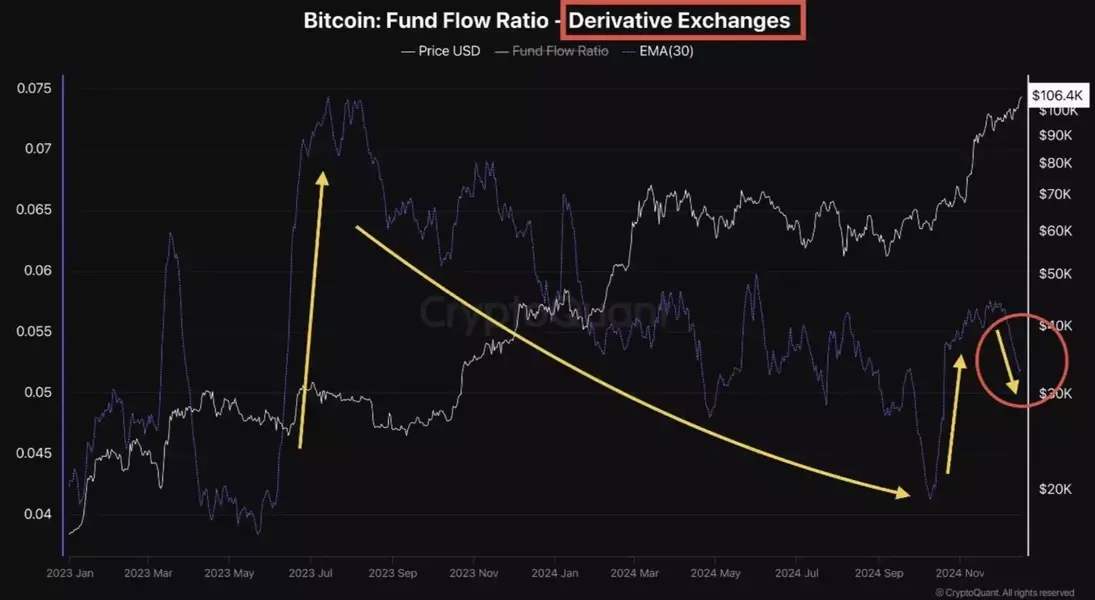

The Bitcoin [BTC] Futures market has witnessed a slowdown in recent times. While the demand from the spot market has remained robust, this trend could potentially push the digital asset's value even higher. According to pseudonymous CryptoQuant analyst Avocado, BTC Futures showed a bounce back in September 2024 but lost its momentum later in early December. This led to a reduction in leverage, which is often a signal of speculative froth and overheating. However, this is a welcome scenario for Bitcoin's upside potential. As Avocado stated, "There are no visible signs of late-cycle overheating. This indicates that Bitcoin's upward trajectory is likely to continue, with significant room for further growth."Healthy BTC Market Amidst Sticky US Inflation

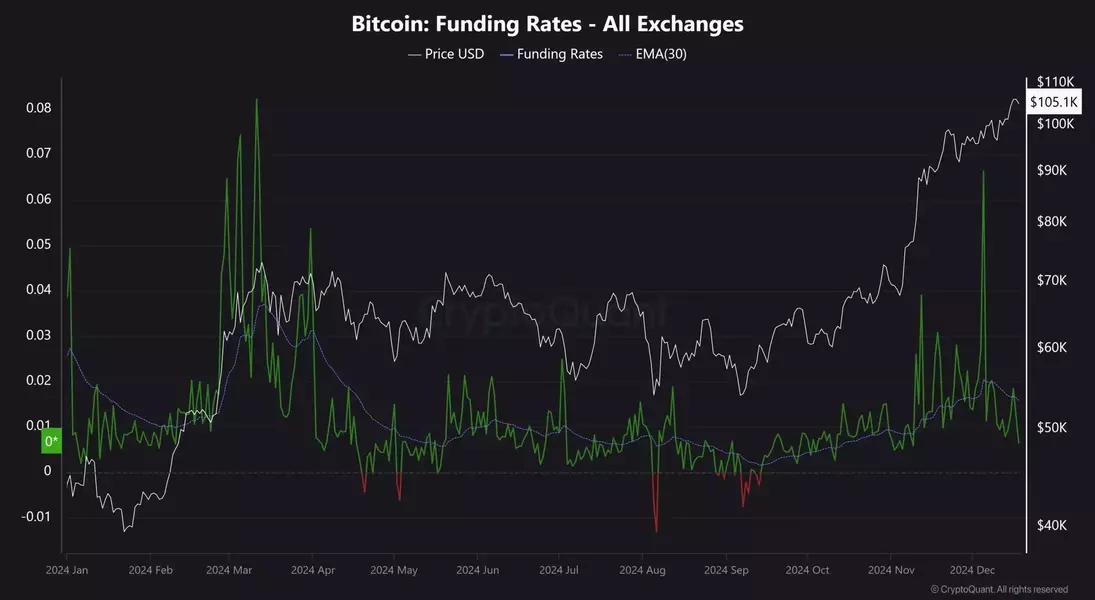

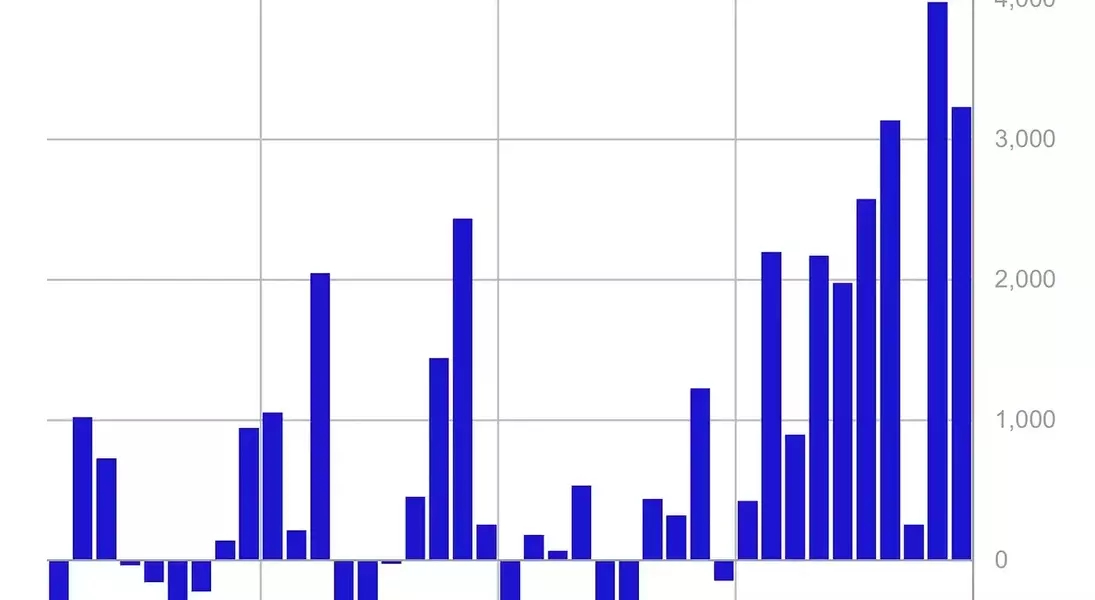

Apart from the short-term caution from the macro front due to sticky US inflation that could potentially derail the Fed rate path, the funding rates in the Bitcoin market have been healthy. Funding rates measure market sentiment and, by extension, the level of leverage and liquidation risks. In fact, the funding rates hit March levels, but the liquidation cascade on the 5th of December triggered a reset to a healthy level. Elevated funding rates in March marked the local top. So, the current levels could potentially allow Bitcoin to soar even higher. On top of that, there is strong spot market demand from US spot ETFs and companies with Bitcoin treasuries like MicroStrategy and Marathon Digital. According to CoinShares data, capital inflows to crypto investment products hit $44.5 billion on a year-to-date (YTD) basis, with Bitcoin leading the way. To put this into perspective, since the US elections in November, Bitcoin products have attracted $11.5 billion in inflows. If this strong spot market demand continues, the cryptocurrency's value could experience a significant explosion.Price Projections and Fib Trend Tool Analysis

Based on the Fib trend tool and measured from the bottom of the 2022 crypto winter, the recent high of $108K coincided with the 1.618 Fib level. The next Fib target is $165K, although most analysts expect a $120K - $200K price target for this cycle top. This indicates that there is still significant room for Bitcoin's value to grow. However, it is important to note that the cryptocurrency market is highly volatile and subject to various factors. As such, these price projections should be taken with a grain of salt.Next: Litecoin – Is the ‘silver to Bitcoin’s gold’ poised for a new rally?You May Like