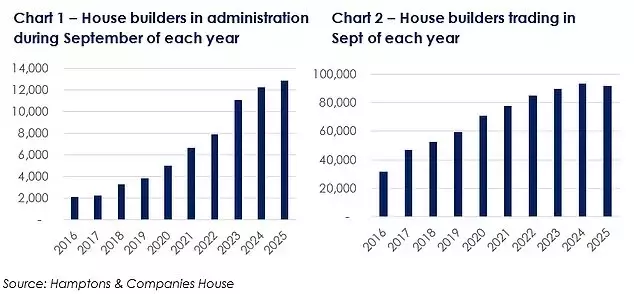

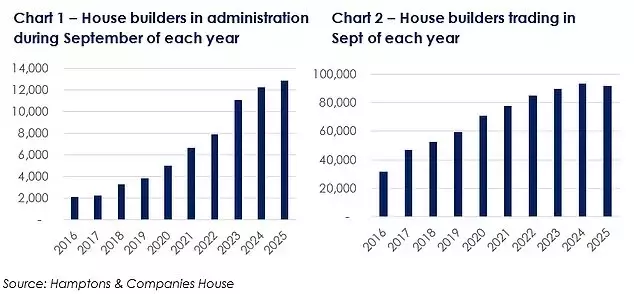

The British housebuilding sector is currently facing considerable headwinds, presenting a unique opportunity for prospective buyers to secure new-build properties at more favorable terms. Data analysis indicates a substantial rise in housebuilders entering administration or liquidation, with a 63% increase compared to last year and a staggering 240% increase since 2019. This challenging environment has led to a noticeable decline in the number of actively trading housebuilders, marking the first annual decrease in over a decade.

This market shift has empowered buyers, making negotiations for discounts and additional incentives on new-build homes more successful than in previous years. Property experts note that developers, eager to finalize sales, are increasingly amenable to offering perks such as furniture packages, upgraded fixtures, cashback, or even covering stamp duty costs. Some buyers have also successfully negotiated reduced deposit requirements, securing deals with as little as a 5% deposit, a significant departure from the typical 15% or higher for off-plan properties.

The current struggles of housebuilders are largely attributed to the conclusion of the Help to Buy scheme in 2023, coupled with broader economic challenges such as rising mortgage rates, increased construction costs, and an uncertain economic outlook. The Help to Buy initiative, which provided government loans to boost buyer deposits for new-builds, had previously fueled a boom in the sector, leading to the emergence of many smaller housebuilding firms. A significant proportion of the companies now failing were established during this period, highlighting their dependence on the scheme. This contraction in the building sector raises questions about the feasibility of the government's ambitious target of constructing 1.5 million new homes by 2029, as current completion rates fall significantly short of the required pace.

In times of market adjustment, resilience and adaptability become paramount. While the current climate presents challenges for the housebuilding industry, it simultaneously opens doors for discerning buyers to capitalize on evolving market dynamics. This period underscores the importance of informed decision-making and strategic negotiation, ultimately fostering a more dynamic and potentially accessible housing market for those prepared to engage with its shifting landscape.