The global automotive industry is currently grappling with a profound transformation as it navigates the shift towards electric vehicles, a journey marked by both ambitious targets and significant setbacks. Major manufacturers, including Ford, are confronting substantial financial losses and strategic reevaluations in their EV programs. This tumultuous period, characterized by unpredictable policy changes and fluctuating consumer demand, has led to a recalibration of investment priorities, moving some companies to pivot towards more immediate profit-generating models while still striving for long-term sustainability in electrification.

Ford's experience provides a stark illustration of these challenges, with the company reporting a staggering $19.5 billion in write-offs related to its electric vehicle initiatives. This colossal sum highlights the immense financial risks associated with pioneering new automotive technologies, especially when market adoption rates fail to meet initial projections. Products like the F-150 Lightning, once heralded as a flagship electric truck, have seen sales fall short of expectations, leading to a re-assessment of production goals and the cancellation of future electric models. This retreat underscores a broader industry struggle to balance innovation with profitability, particularly in a market that remains sensitive to vehicle cost and charging infrastructure availability.

Adding to the complexity is the volatile political landscape in the United States, which has created what industry experts term 'EV Whiplash.' Policy swings between administrations, such as President Biden's push for EV subsidies and charging infrastructure expansion versus President Trump's emphasis on relaxing fuel economy standards and critiquing EV policies, introduce considerable uncertainty for automakers. These rapid shifts make long-term strategic planning incredibly difficult and costly for an industry that requires years, if not decades, to develop and launch new vehicle platforms. The lack of a consistent national strategy exacerbates investment risks, forcing manufacturers to adapt quickly to divergent regulatory environments.

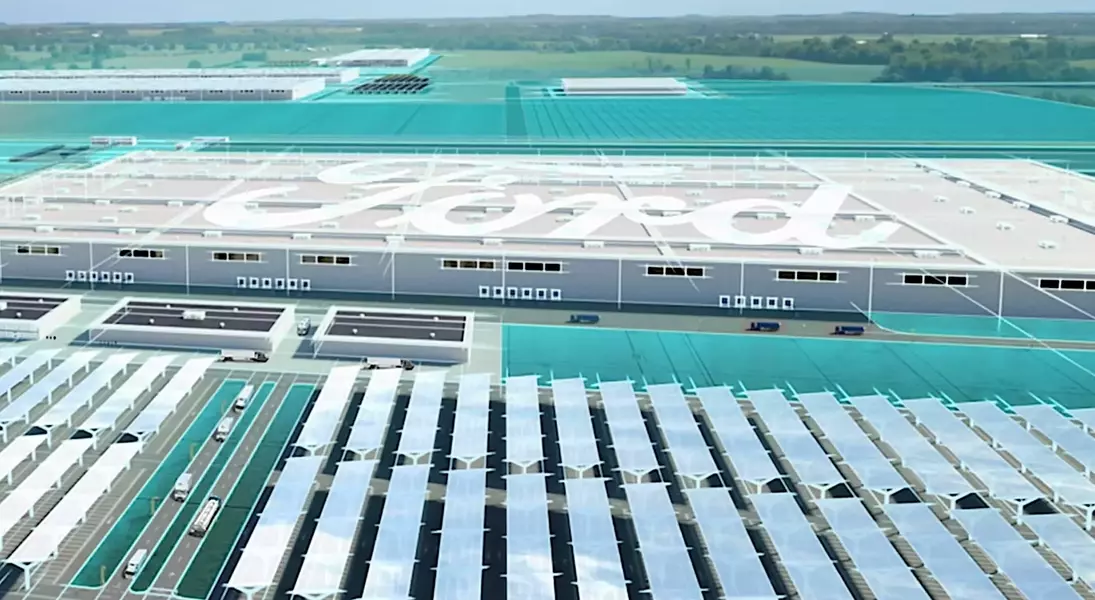

Consequently, many automakers, including Ford, GM, and Stellantis, are undergoing significant restructuring, involving layoffs in EV divisions, the repurposing of production facilities, and a renewed focus on more profitable internal combustion engine (ICE) vehicles, especially high-margin SUVs and pickup trucks. Ford's ambitious 'Blue Oval City' project, initially envisioned as a major EV production hub, is being reconfigured to produce traditional ICE trucks. This strategic adjustment reflects a pragmatic response to current market realities, where consumer preferences and affordability often favor conventional vehicles over their electric counterparts, at least in the short term. The challenge remains to find a pathway to broad EV adoption that is both economically viable for manufacturers and appealing to a wider consumer base.

Despite the current headwinds, the commitment to electrification has not entirely waned. Automakers are exploring alternative solutions, such as extended-range electric vehicles (EREVs) and advanced hybrids, which offer a bridge between traditional ICE cars and fully electric models. These vehicles aim to address consumer concerns about range anxiety and charging infrastructure by combining electric powertrains with internal combustion engines for extended travel. This hybrid approach allows manufacturers to continue their transition towards electrification while mitigating some of the financial and logistical risks associated with pure EVs. The success of these interim solutions will depend on consumer understanding and willingness to pay a premium for the technology, as well as the industry's ability to demonstrate clear benefits in energy savings and environmental impact.

The fluctuating market dynamics and policy inconsistencies mean that while automakers are gaining some breathing room in their EV transitions, they are also navigating a complex global competitive environment. Maintaining a balance between domestic market demands for traditional vehicles and the imperative to innovate for a global, increasingly electric future, especially in the face of competition from regions like China, remains a critical challenge. The industry continues to invest in next-generation EV technologies and platforms, with a long-term vision of making electric mobility both affordable and widespread, but the immediate path forward involves a more diversified and adaptive strategy.