Key Recommendations to Cut the Gap

Requirement for Local Permitting Agencies

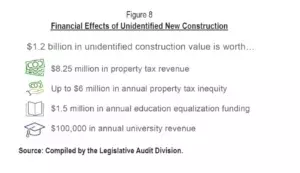

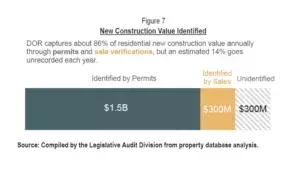

Local permitting agencies are urged to send copies of permits to the Department of Revenue. This would enhance the department's ability to keep track of new construction and ensure accurate property valuations. By having access to these permits, the department can better determine where properties have been renovated or received additions, leading to more accurate tax assessments.Currently, many permits are not stored centrally, and staff often has to pick up paper copies in some counties while others send them electronically. This disjointed system leads to delays and inaccuracies in the department's records. By implementing this recommendation, the process would be streamlined, and the department would have a more comprehensive view of new construction.

Improved Permitting Process

A better process for statewide permitting is needed. This would involve establishing clear protocols and procedures for issuing permits and ensuring their timely transmission to the Department of Revenue. Such a process would minimize errors and delays, allowing the department to more effectively monitor new construction and assess property values.Currently, the permitting process can be cumbersome and inconsistent across different jurisdictions. By creating a standardized and efficient permitting process, the Department of Revenue can better fulfill its role in tax assessment and revenue collection. This would also benefit local municipalities by providing them with more accurate information for budgeting and planning.

Aerial Imagery for Property Inspections

Investing in aerial imagery similar to that used by other states and the federal government could be a game-changer. Aerial imagery can provide a comprehensive view of properties, especially those that are hard to reach on the ground. This would allow the Department of Revenue to conduct more accurate property inspections and identify new construction more efficiently.In Montana's vast rural lands, on-site inspections can be challenging and time-consuming. Aerial imagery offers a cost-effective alternative that can cover large areas quickly and accurately. By incorporating aerial imagery into their inspection process, the department can significantly increase their efficiency and accuracy in assessing new construction.

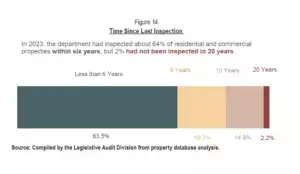

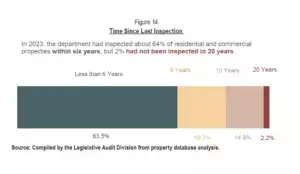

Inspection of Uninspected Properties

The department should work to inspect more properties that have not been inspected in six or more years. By mapping these properties and bolstering staff resources, the department can ensure that every property is being inspected within a reasonable timeframe.Currently, more than one-third of Montana properties have not been inspected in over six years, and 15% have not been inspected in at least a decade. This lack of inspection leads to inaccuracies in property valuations and tax assessments. By focusing on these uninspected properties, the department can improve the fairness and accuracy of the tax system.

Staff Retention and Expansion

The Department of Revenue needs to build a plan to retain more staff and potentially expand its workforce. Staffing levels have a significant impact on the department's ability to conduct reappraisal reviews and inspections. With a larger and more stable staff, the department can be more proactive in identifying new construction and ensuring accurate tax assessments.The Legislature cut the department's staff in 2017 and 2019, and there has been turnover in the years since. This has led to a backlog in inspections and a decrease in the department's efficiency. By addressing staffing issues and providing the necessary resources, the department can improve its performance and fulfill its mission more effectively.

In conclusion, the Montana Department of Revenue's struggle to keep up with property inspections and capture new construction value is a complex issue that requires a multi-faceted approach. The recommendations outlined in the legislative audit offer a promising path forward, but their implementation will depend on adequate funding and support from the legislature and the governor's office. By addressing these issues, the department can improve the fairness and accuracy of the tax system and ensure that local municipalities receive the revenue they need to provide essential services.