ATI Inc., a key player in the specialty materials sector, is positioned for substantial growth, primarily driven by its significant involvement in the aerospace and defense industries. The company has garnered a 'strong buy' recommendation, with analysts setting a price target of $139.78. This optimistic outlook is a direct result of ATI's strategic market focus and projected financial performance.

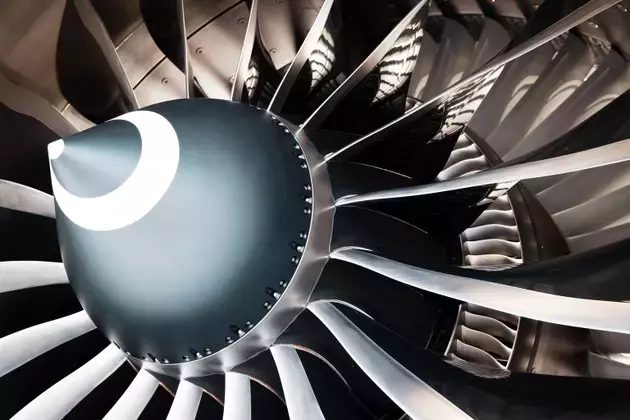

A remarkable 70% of ATI's sales are generated from the aerospace and defense segments. This deep integration allows the company to capitalize on robust demand within these critical sectors. The burgeoning jet engine market, coupled with sustained growth in defense spending, is expected to fuel a double-digit expansion in both revenue and profit margins for ATI. These factors collectively underscore the company's strong market position and its potential for sustained financial success.

Financial forecasts for ATI Inc. paint a promising picture. The company's Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) are anticipated to increase at a compound annual growth rate (CAGR) of 15%. This robust growth trajectory is complemented by an impressive 47.5% projected rise in free cash flow, indicating enhanced liquidity and operational efficiency. Furthermore, ATI is expected to significantly de-leverage its balance sheet, with the leverage ratio predicted to drop from 1.6x to a healthier 0.9x by 2027. This reduction in debt burden suggests improved financial stability and increased flexibility for future investments or shareholder returns.

Beyond its core operational performance, ATI Inc. presents additional upside potential for investors. The company has the flexibility to pursue increased share repurchases, which could further boost shareholder value by reducing the number of outstanding shares. Alternatively, initiating dividend payments could also enhance investor returns. These optionalities, combined with the company's strong growth fundamentals, make ATI an attractive investment, even when considering its current valuation premiums.

In summary, ATI Inc. stands out as a compelling investment opportunity. Its strategic focus on high-growth aerospace and defense markets, coupled with strong financial projections, positions the company for significant expansion. The potential for improved shareholder returns through various capital allocation strategies further enhances its appeal, making it a noteworthy consideration for investors seeking exposure to these dynamic industries.