AST SpaceMobile recently made headlines with a significant financial maneuver, announcing a $1 billion convertible senior note offering. This strategic move, detailed in a private offering, has led to a notable dip in the company's stock value, reflecting investor concerns about potential dilution. The funds are earmarked for critical corporate objectives, primarily the deployment of its ambitious global satellite network. This event underscores the substantial capital demands of advanced space technology ventures and highlights the delicate balance between securing financing and managing investor sentiment.

AST SpaceMobile Navigates Financial Waters Amidst Satellite Deployment Plans

In a significant development on October 22, 2025, AST SpaceMobile, a pioneering force in satellite-based broadband services and a contender in the space alongside industry giants like Elon Musk's Starlink, witnessed a decline in its stock value following a major financial announcement. The company disclosed a private offering of $1 billion in convertible senior notes, due in 2036, a figure that surpassed its initial target of $850 million. This offering, structured with an initial conversion price of $96.30, represented a 22.5% premium over its closing price the preceding day, subsequently extending to nearly 40%.

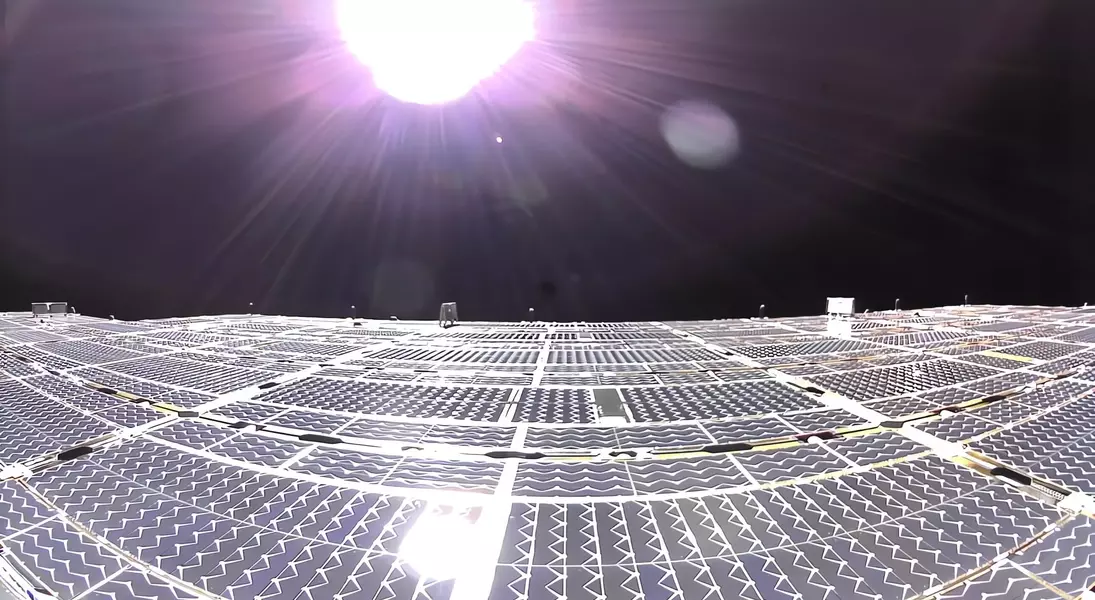

The notes carry a modest interest rate of 2%, and the agreement includes an option for purchasers to acquire an additional $150 million in notes. AST SpaceMobile anticipates receiving approximately $981.9 million in net proceeds from this sale. These funds are designated for general corporate purposes, with a primary focus on accelerating the deployment of its extensive worldwide constellation of satellites, a cornerstone of its business model.

The market's reaction was swift and pronounced, with shares of AST SpaceMobile (NASDAQ: ASTS) dropping by 13.5% by midday on the announcement date. This downturn is largely attributed to investor apprehension regarding potential dilution, a common concern when companies, especially those not yet generating substantial profits, raise capital through such means. While convertible debt does not immediately dilute existing shareholders, it sets the stage for future dilution if the notes are converted into equity.

Despite this immediate market response, company management remains optimistic, projecting the commencement of meaningful revenue generation in the second half of the year. They are targeting between $50 million and $75 million in revenue as the company rolls out intermittent service across the United States. However, the inherently high upfront costs associated with developing and launching satellites suggest that AST SpaceMobile may need to secure additional capital in the future, implying further potential for dilution. The company currently commands a market capitalization of $26 billion, indicating a significant valuation despite its pre-profitability phase.

From a journalist's vantage point, this development presents a classic dilemma for high-growth, capital-intensive technology companies. While securing significant funding is crucial for executing ambitious projects like a global satellite broadband network, the method of financing invariably impacts investor confidence and stock performance. The choice of convertible debt over a direct equity offering indicates an attempt to mitigate immediate dilution and leverage a lower interest rate, yet the underlying need for future capital raises remains a salient point for investors. It underscores the long-term vision and substantial risks inherent in pioneering new frontiers, where initial expenditures far precede revenue streams. This situation highlights the fine line between aggressive expansion and prudent financial management, a balance that AST SpaceMobile must skillfully maintain to realize its transformative potential.