Investment firms are maintaining an optimistic stance on Asian high-yield bonds, driven by attractive yields and a generally positive economic forecast. Despite concerns in the Chinese property market, financial experts see significant potential in this asset class.

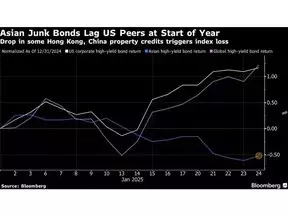

Despite initial setbacks, the performance of Asian speculative-grade debt has shown resilience compared to global peers. While some sectors, particularly those tied to Chinese real estate, have faced challenges due to refinancing worries, many other industries within the region have demonstrated robust growth. For instance, utilities and basic materials sectors have posted gains, indicating a broader stability in the market. The shorter average maturity of Asian bonds also makes them less vulnerable to interest rate fluctuations, further bolstering investor confidence. Financial analysts highlight that companies in the region possess solid balance sheets, enabling them to weather any mild economic downturns.

PineBridge Investments and JPMorgan Asset Management anticipate a promising year for Asian high-yield bonds, expecting returns in the high single digits by year-end. With yields hovering around 10% and default rates projected to decline, these investments offer compelling opportunities. The reduced influence of the Chinese property sector in the overall market means that other segments are gaining prominence. Investors remain confident that Asia's economic outlook will support continued growth in this asset class. Moreover, limited exposure to US markets insulates these bonds from direct impacts of tariffs, although broader market dynamics may still play a role. Overall, the outlook for Asian high-yield bonds remains encouraging, reflecting the region's resilience and attractiveness to investors seeking higher returns.