Ethereum's Ascent: A Bullish Shift in the Crypto Landscape

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has been making waves in the digital asset space, showcasing a remarkable performance that has captured the attention of investors and analysts alike. As the global cryptocurrency market experiences a robust surge, Ethereum's growth has been a key driver, signaling a potential shift in the broader crypto landscape.Unlocking the Potential of Ethereum's Bullish Momentum

Ethereum's Surge and the Broader Crypto Market Dynamics

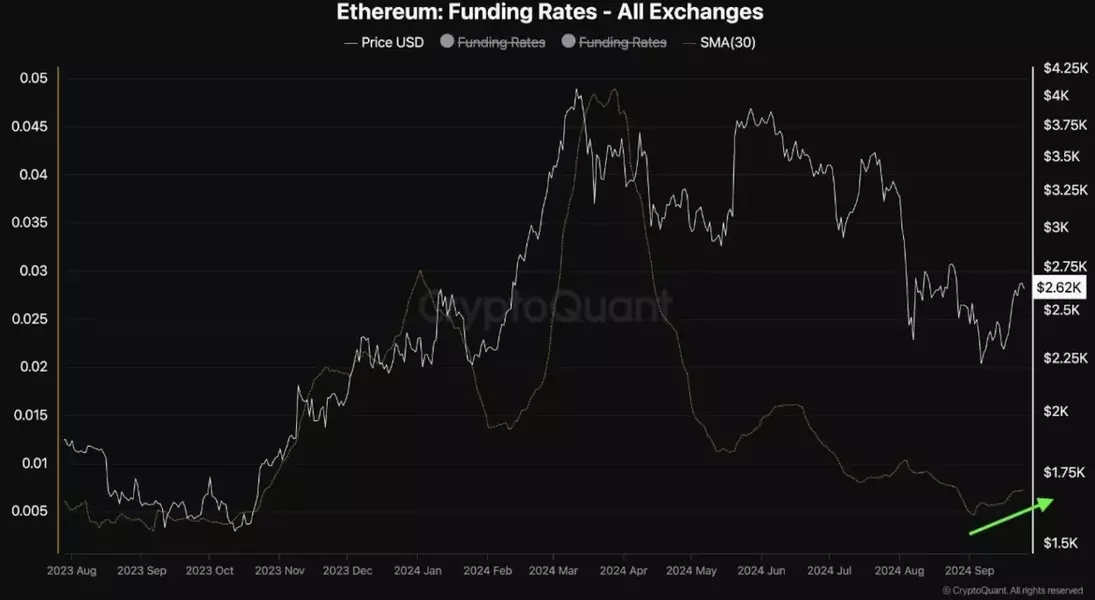

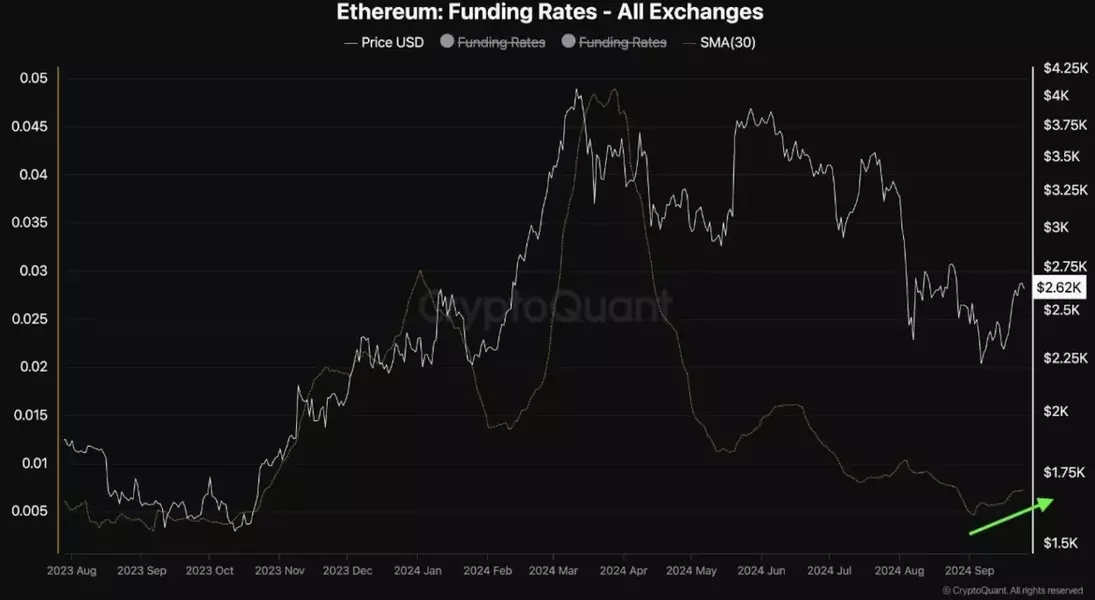

Ethereum's recent price surge, climbing over 1.75% in the past 24 hours, has coincided with a notable increase in Bitcoin's value, which gained more than 3% during the same period, crossing the $65,500 threshold. This synchronous movement has contributed to a robust 2.65% increase in the global cryptocurrency market cap, reaching approximately $2.3 trillion.The driving force behind Ethereum's growth appears to be a significant rise in buying activity, as observed on-chain. Analyst ShayanBTC from Cryptoquant highlighted the bullish shift in Ethereum's futures market, emphasizing that funding rates were pointing to a potential price recovery. This suggests that the perpetual futures market is playing a crucial role in influencing Ethereum's price movements, making it essential to assess the sentiment of futures traders for clues about potential price trends.Analyzing the Perpetual Futures Market's Impact on Ethereum

In a detailed analysis on the firm's website, the pundit delved into the importance of the perpetual futures market in driving market price movements. The report noted that the perpetual futures market plays a significant role in shaping price dynamics, underscoring the need to closely monitor the sentiment of futures traders to gain insights into potential price trends.The analysis focused on Ethereum's 30-day moving average of funding rates, a crucial metric that indicates whether buyers or sellers are more aggressive in executing market orders. Recently, this average has shown a slight bullish shift after a prolonged period of decline, signaling an increase in buying activity among futures traders."The rise in funding rates indicates an increase in buying activity among futures traders, signaling that market participants may be turning more bullish," the pundit explained. According to the analysis, for Ethereum to maintain its recovery and target higher price levels, demand in the perpetual futures market must continue to rise. A sustained uptrend in funding rates could lead to further price surges in the mid-term, although consistent buying is needed to maintain this momentum.Technical Analysts' Bullish Outlook for Ethereum

In addition to the insights from the perpetual futures market, various technical analysts have also shared a bullish outlook for Ethereum in the long term. "EtherNasyonal" noted on Friday that Ethereum appears to be entering a final accumulation phase similar to the one it experienced in August-September 2020, just before a significant price surge.According to the pundit, should history rhyme, ETH could surge to $10,000 in the next bull cycle. This optimistic projection is based on the belief that Ethereum is poised to replicate a similar pattern of accumulation and subsequent price appreciation, as observed in the previous bull run.However, not all analysts share the same level of enthusiasm for Ethereum's immediate outlook. Analyst Alan Satana has voiced concerns about the cryptocurrency's short-term prospects. In a Wednesday tweet, he observed that the weekly candlestick chart is now showing a bearish trend after a promising start, and he further pointed out the absence of trading volume, which often indicates weak bullish momentum.Satana's analysis suggests that since May, each price drop has typically been followed by a couple of green sessions before reverting to a bearish trend. He further cautioned that "the baseline level as support was challenged recently," projecting a potential price range for lower lows between $1,750 and $1,500, with an even lower range sitting in the low $1,000s.Despite the mixed perspectives, the overall sentiment surrounding Ethereum's long-term trajectory remains predominantly bullish, with analysts closely monitoring the perpetual futures market and technical indicators to gauge the cryptocurrency's potential for further growth.