Nvidia's earnings and guidance have had a significant impact on the overall market and specific AI-related stocks. This article delves into the details of these movements and their implications.

Unraveling the Impact of Nvidia's Earnings on the Market

Overview of Dow Jones Futures and S&P 500 Futures

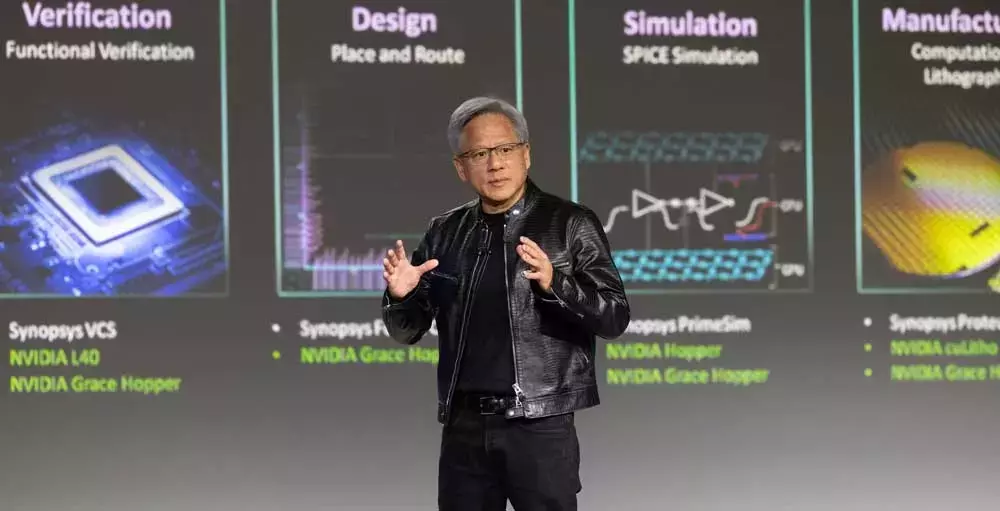

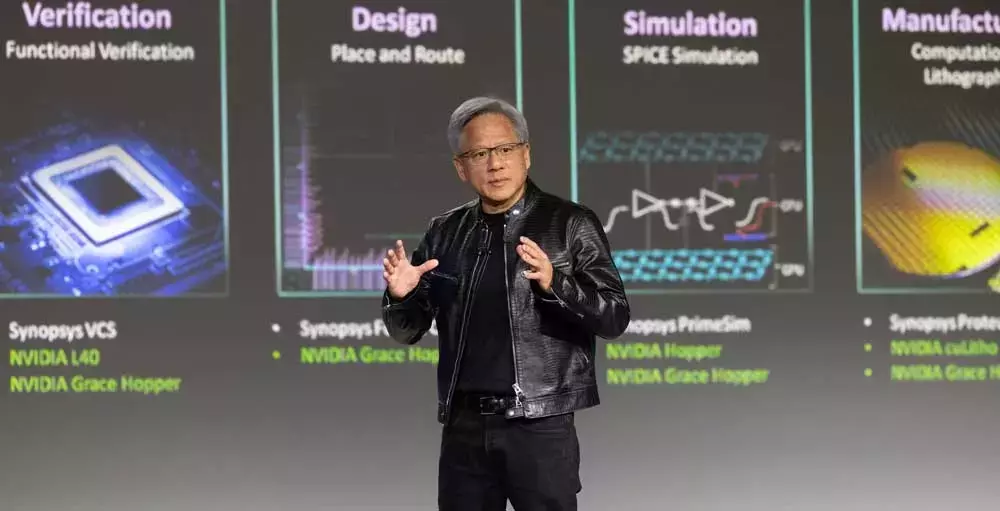

After hours, Dow Jones futures and S&P 500 futures showed a tilt towards higher levels, while Nasdaq futures edged lower. This initial movement sets the stage for a detailed analysis of the market's behavior.The major indexes closed narrowly mixed on Wednesday, with a strong finish after testing and holding key levels. This indicates a certain stability in the market, despite the initial differences in futures.Nvidia, as a new Dow member, played a crucial role. Its earnings beat views, with a triple-digit year-over-year gain for the sixth straight quarter and revenue soaring 94%. The AI chip giant's guidance on revenue for the January-ended quarter was slightly up, highlighting its dominant position in the market.Impacts on Other AI Chip Stocks

Recent IPO Astera Labs rose modestly in overnight action, with a 2.35% increase to 97.42 on Wednesday after a 5.3% jump the prior session. Investors can use 100.09 as a high handle entry.Nvidia chipmaker Taiwan Semiconductor, Broadcom, Arm Holdings, and Advanced Micro Devices were roughly flat. TSM stock closed just above the 50-day line, while the other three are below that key level.Arista Networks, a networking play, nudged lower after hours, although it rose 1.1% on Wednesday. Shares have fallen below the 50-day line but have found support around the top of a prior base.Performance of Other Earnings Reports

Palo Alto earnings beat views, but revenue just topped. PANW stock fell solidly overnight, signaling moves below buy points of 380.84 and 384. However, it climbed 1.2% to 392.61 on Wednesday.Snowflake earnings comfortably topped consensus, and shares surged in late trade, indicating a move back above the 200-day.Stock Market Rally and ETF Movements

The stock market rally again came well off morning lows, with all key indexes testing and holding their 21-day moving averages and improving into the close.Among growth ETFs, the Innovator IBD 50 ETF dipped 0.2%. The iShares Expanded Tech-Software Sector ETF rose 0.8%, with Palo Alto stock a significant holding. The VanEck Vectors Semiconductor ETF slipped 0.7%, with Nvidia stock as the dominant holding and Taiwan Semiconductor and Broadcom also key members.ARK Innovation ETF fell 1.1% and ARK Genomics ETF edged up 0.4%.SPDR S&P Metals & Mining ETF was 0.2%. The SPDR S&P Homebuilders ETF climbed 1%. The Energy Select SPDR ETF advanced 1% and the Health Care Select Sector SPDR Fund gained 1.2%.The Industrial Select Sector SPDR Fund edged up 0.1%, and the Financial Select SPDR ETF dipped 0.3%.What to Do Now

The stock market rally has shown healthy action, with the major indexes holding key levels. If stocks react well to Nvidia earnings, a number of stocks could flash buy signals. But a negative reaction could signal trouble for the market rally.So, it is important to be prepared with up-to-date watchlists and exit strategies. Reading The Big Picture every day helps stay in sync with the market direction and leading stocks and sectors.Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.You May Like