Recent developments within the semiconductor industry have ignited considerable discussion regarding a potential shift in chip manufacturing dynamics. A specific job advertisement from AMD, seeking experts in "PowerVia" technology, has fueled speculation that the company might be considering Intel's fabrication facilities for upcoming chip production. This move, if it materializes, could significantly alter the competitive landscape and AMD's long-standing reliance on other foundries.

This evolving situation highlights the complexities of modern semiconductor production and the strategic decisions companies face in an increasingly competitive global market. The potential collaboration between these two industry giants, traditionally fierce rivals, could mark a new era of strategic partnerships aimed at optimizing manufacturing capabilities and securing supply chains within the United States.

AMD's Strategic Recruitment and the PowerVia Implication

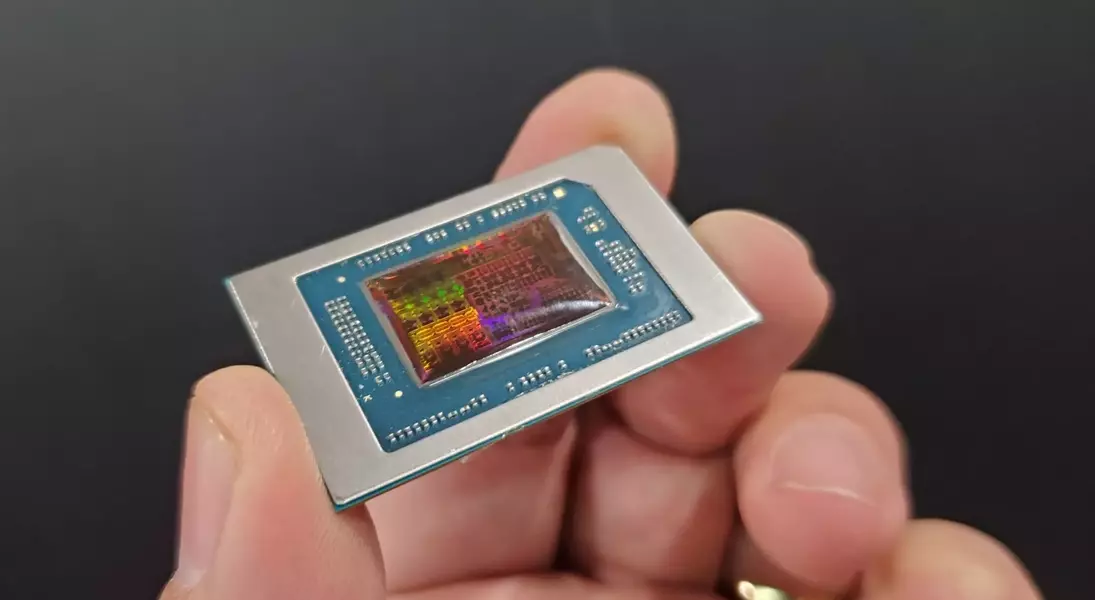

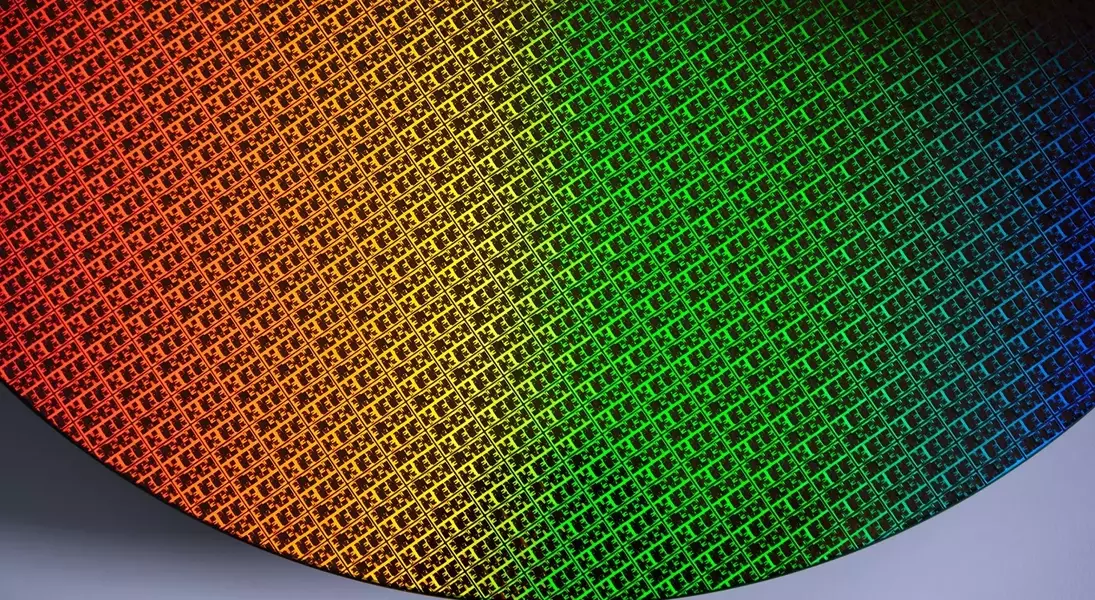

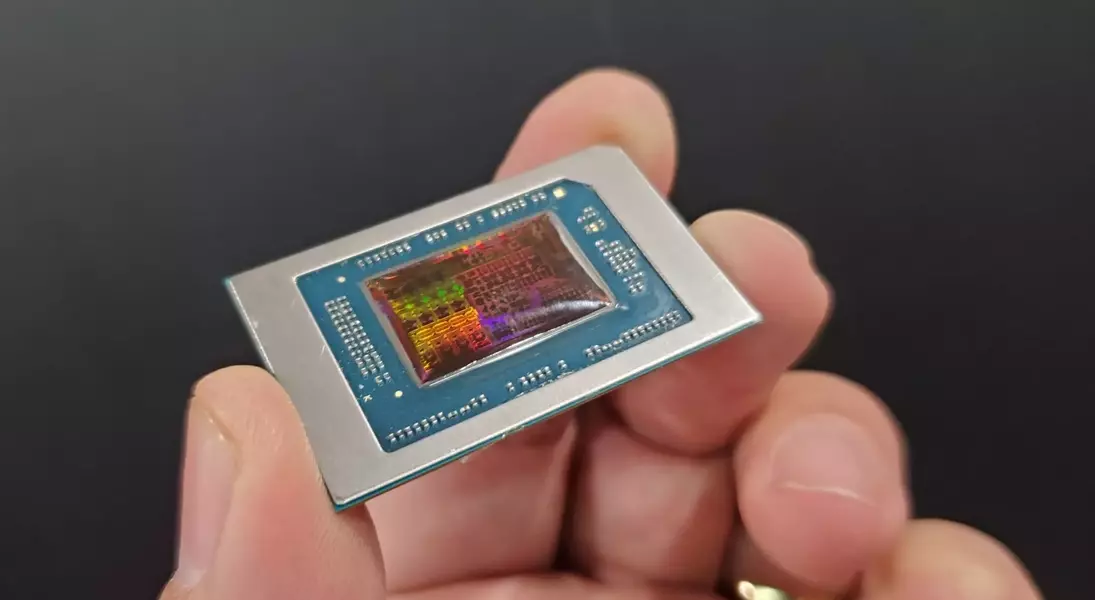

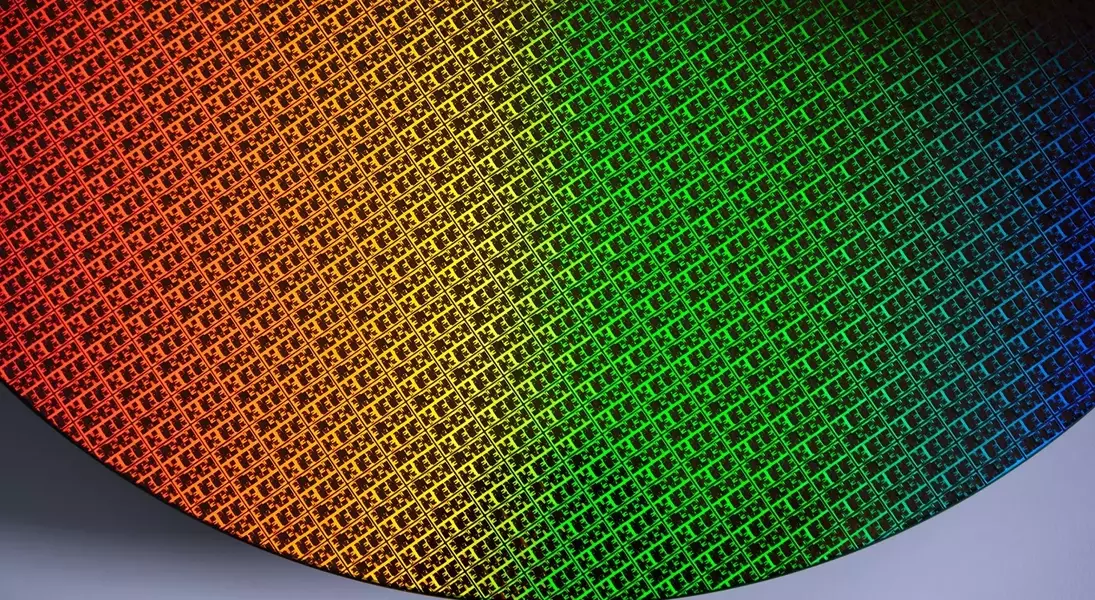

AMD's recent job posting for engineers proficient in "PowerVia" technology has prompted intense speculation across the semiconductor sector. "PowerVia," Intel's branded approach to backside power delivery, represents a significant advancement in chip design, promising enhanced performance and efficiency by relocating power networks beneath the transistors. This technology is set to debut on Intel's cutting-edge 18A node, and AMD's interest in hiring specialists with this specific expertise suggests a deeper engagement than mere evaluation. The industry is buzzing with the possibility that AMD might be preparing to "tape out" its designs for manufacturing at Intel's facilities, signaling a strategic pivot towards domestic production and a potential re-evaluation of its foundry relationships.

The advertisement has sparked widespread debate regarding AMD's future manufacturing strategy. "PowerVia" is a key innovation for Intel's next-generation processors, and AMD's recruitment drive for individuals skilled in this area strongly implies a direct interest in integrating this technology into its own product lines. This could signify AMD's intention to leverage Intel's advanced manufacturing capabilities, particularly the 18A node, which is seen as crucial for achieving higher performance and energy efficiency. Such a partnership would not only bolster chip manufacturing within the United States but also introduce a new dynamic into the competitive foundry market, potentially giving AMD greater leverage in its ongoing negotiations with TSMC, its primary chip supplier.

Navigating the Foundry Landscape and Future Prospects

The prospect of AMD utilizing Intel's fabrication plants introduces a fascinating twist in the semiconductor industry's competitive narrative. While the direct mention of "PowerVia" in AMD's job description points towards a potential manufacturing agreement, alternative interpretations suggest that AMD might be enhancing its understanding of Intel's technological advancements to strengthen its bargaining position with TSMC. TSMC is also on track to implement its own backside power solutions with the A16 node, setting the stage for a technological race. Intel's past experiences with early node adoption, such as the 10nm Cannon Lake chips, underscore the challenges of achieving high yields and scaling production, making AMD's decision contingent on Intel's proven capabilities with 18A.

Ultimately, AMD's decision to potentially partner with Intel's fabs would involve a careful assessment of various factors, including Intel's readiness for large-scale, high-yield production on its 18A node. The historical context of Intel's node transitions, particularly the initial hurdles with 10nm technology, highlights the importance of reliable manufacturing at scale. While Intel aims to release its Panther Lake CPU with 18A silicon soon, AMD will likely scrutinize the actual yields and performance before committing to a significant shift from TSMC, a long-standing and reliable partner. This strategic consideration involves not only technological compatibility but also the broader implications for supply chain resilience and market positioning against industry heavyweights like Apple, who also rely on leading-edge foundries.