A recent analysis by Mercury Research and Jon Peddie Research highlights the ongoing competition between AMD and Intel in the processor market. The findings indicate a positive trajectory for AMD, especially in the desktop CPU segment, even as Intel continues to hold a dominant position overall.

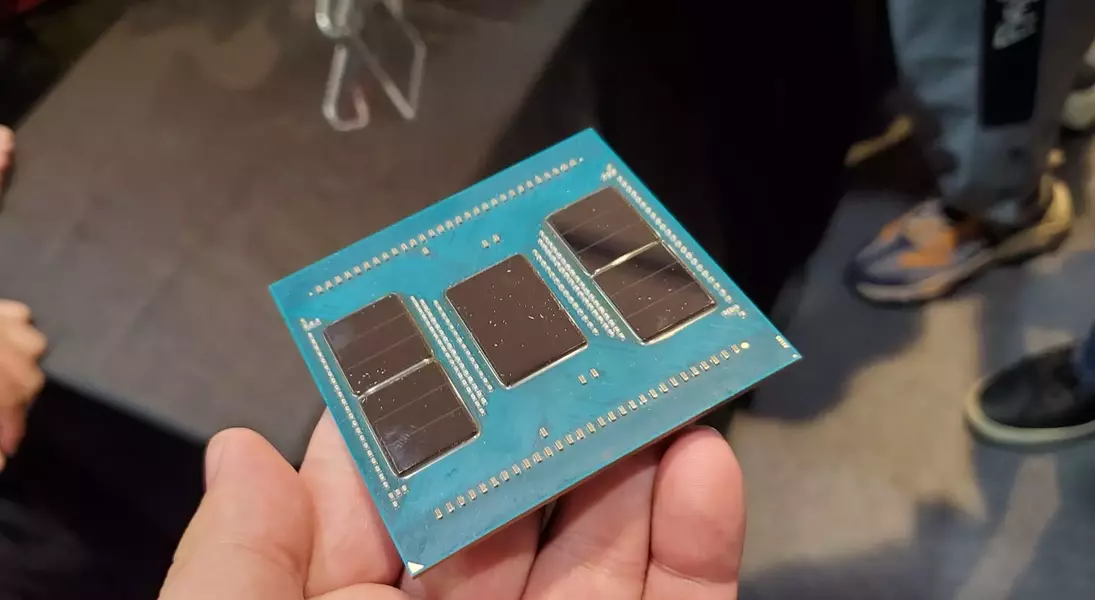

According to Mercury Research's latest report, AMD's share of the x86 CPU market (excluding embedded and IoT processors) reached 29.2% in the last quarter of 2025, marking a 4.5% improvement year-over-year. Specifically, AMD's desktop chip market share expanded by 9.5%, now accounting for over 36% of the total. Although growth in mobile and server sectors was more modest, increasing by 2.2% and 3.1% respectively, the performance of AMD's Epyc server CPUs is noteworthy, with the fifth-generation Turin processors contributing over half of the company's server revenues for the first time. This shift is partly attributed to Intel's strategic decision to prioritize server CPU manufacturing, which impacted its ability to supply PC processors, particularly in the mobile client CPU market, leading to a decline in Intel's shipments.

While Mercury Research observed an unusual sequential decline in x86 processor unit shipments in the fourth quarter, Jon Peddie Research presents a slightly different perspective, reporting a modest 2.7% sequential growth in the global client CPU market for the same period, following four consecutive quarters of expansion. Dr. Jon Peddie commented that this growth aligned with typical seasonal purchasing patterns, albeit at a somewhat reduced rate, influenced by factors such as fluctuating tariffs and Microsoft's discontinuation of Windows 10 (2016) support. Both research firms concur on the robust performance of the server CPU market, with a 6.5% quarter-over-quarter increase and a 13.6% year-over-year rise, largely driven by the demand for AMD Epyc and Intel Xeon processors.

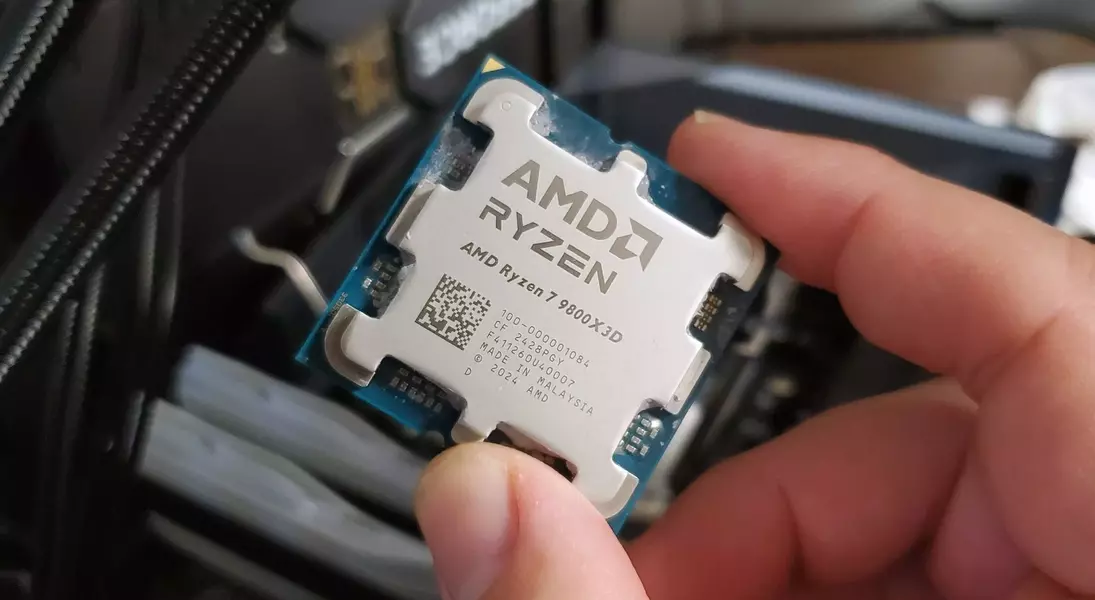

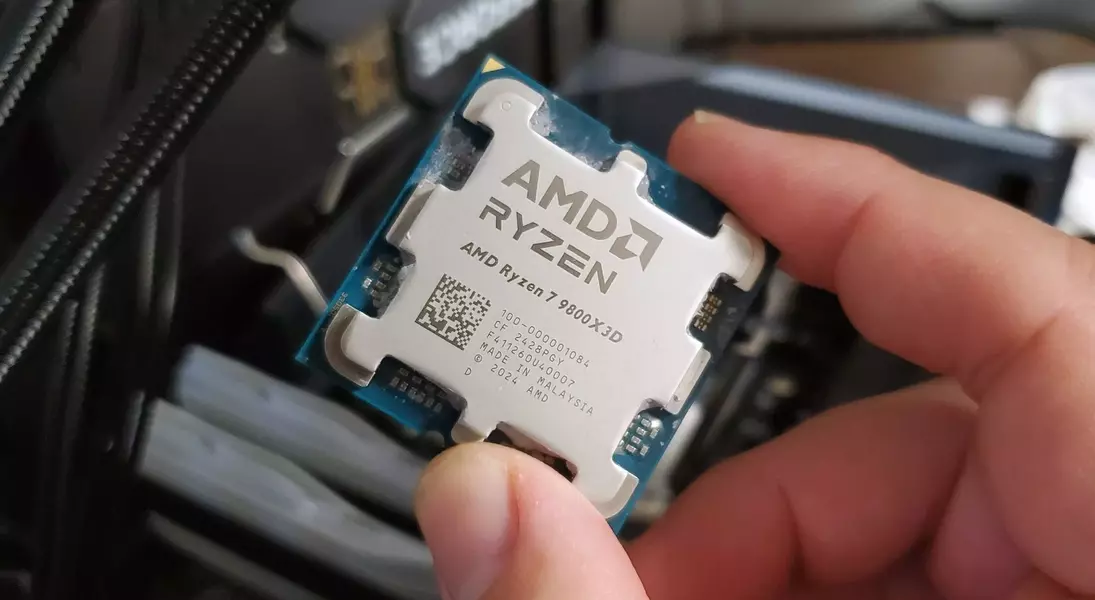

Looking ahead, the market anticipates the launch of new desktop processors from both AMD (Zen 6) and Intel (Nova Lake) in 2026. However, the outlook for market share dynamics remains uncertain, with potential challenges posed by rising DRAM prices and limited availability. The expectation is a general decrease in overall chip shipments until improvements in the global memory supply chain materialize, underscoring the interconnectedness of various components within the technology ecosystem and their impact on broader market trends.