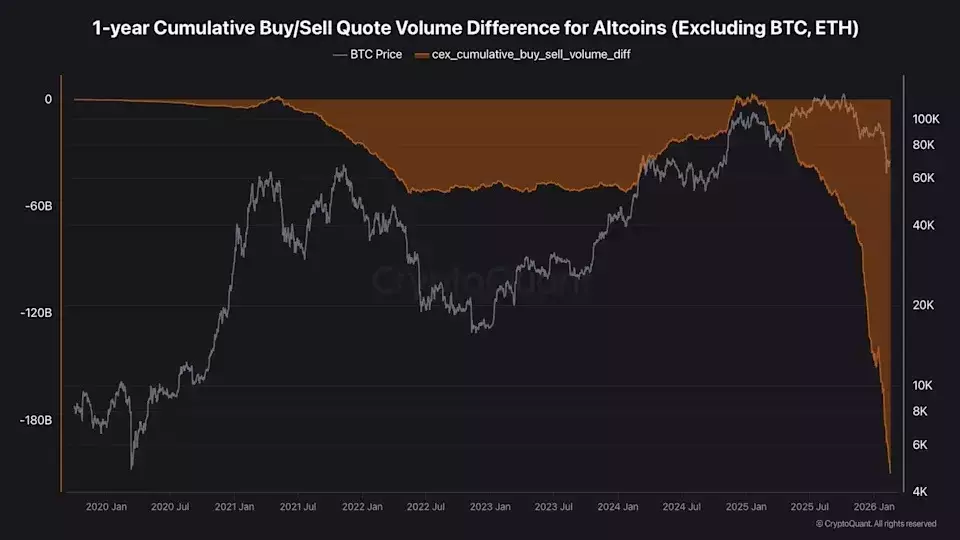

The altcoin market has faced an unprecedented period of sustained selling, with its total capitalization (TOTAL2) remaining below $1 trillion and market sentiment reaching historic lows. This extended downturn, marked by 13 consecutive months of net selling pressure totaling -$209 billion, has left many investors questioning if the market has finally hit its rock bottom. Unlike previous bear cycles, the current environment has not seen a slowdown in selling pressure, leading to concerns about the overall health and future direction of altcoins.

Further complicating the market landscape, derivatives data reveals a significant shift in investor behavior. Traders are increasingly favoring long positions in Bitcoin over altcoins, indicating a reduced appetite for altcoin volatility. This trend, unprecedented in its duration, highlights a cautious approach among short-term traders. Moreover, the sheer volume of altcoins now available presents a formidable challenge. With the total altcoin market capitalization back to levels seen five years ago, but with a 70-fold increase in the number of listed tokens, competition for investor capital is fiercer than ever. This oversupply, particularly in the low-cap segment, makes a broad market recovery more difficult and threatens the survival of numerous projects.

Looking ahead, the current bear market is poised to fundamentally reshape investment strategies within the altcoin sector. With over half of all cryptocurrencies listed on GeckoTerminal having failed by the end of 2025, and millions of tokens collapsing in that year alone, market participants are expected to become far more discerning. The emphasis will likely shift towards projects with strong fundamentals, proven liquidity, and sustainable value propositions, leading to a more selective allocation of capital and a reduced exposure to highly speculative assets. This period of contraction, while challenging, could ultimately foster a more mature and resilient altcoin ecosystem.

In these turbulent times, perseverance and informed decision-making are paramount. While the market's current state may seem daunting, it also presents an opportunity for growth and refinement. By focusing on innovation, transparency, and real-world utility, projects can distinguish themselves and contribute to a more robust future for the cryptocurrency space. The path forward demands diligence and a belief in the transformative potential of digital assets, even as the landscape evolves.