The artificial intelligence arena is experiencing a profound shift, drawing parallels to the internet's formative years, as innovative startups emerge and reshape the competitive landscape. Groq, a notable newcomer, is challenging the established dominance of AI semiconductor manufacturers such as Nvidia and Advanced Micro Devices. However, rather than undermining these industry titans, Groq's innovative approach appears to be fueling an even greater demand for AI technologies, thus expanding the market for all participants.

A key development in this evolving market is Groq's introduction of the Language Processing Unit (LPU), specifically engineered for AI inference tasks. Unlike general-purpose Graphics Processing Units (GPUs) traditionally supplied by Nvidia and AMD, LPUs excel in the specialized process of analyzing data and drawing conclusions from trained AI models. This focused efficiency has garnered significant attention, attracting substantial investment and validating the market's appetite for specialized AI hardware. In response, established players like AMD are diversifying their offerings, developing Neural Processing Units (NPUs) and other specialized AI chips to meet the increasingly granular demands of AI applications. Nvidia too, is making strategic moves, securing deals to supply its chips to major AI players like OpenAI, ensuring its continued relevance in a rapidly segmenting market.

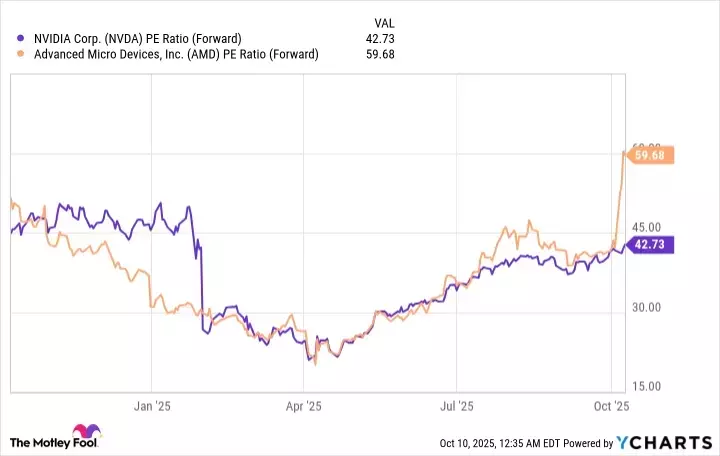

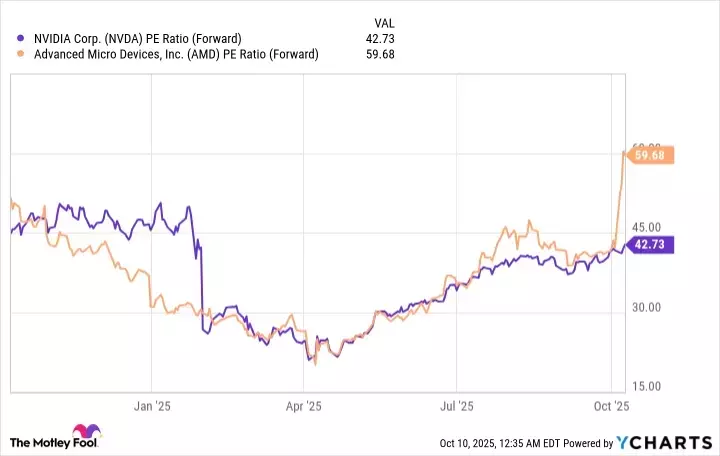

While Groq's ascent demonstrates a growing openness to alternatives in a market heavily influenced by Nvidia, which holds a substantial share, it also presents an opportunity for companies like AMD to bolster their positions. This competitive dynamic may also benefit Nvidia by potentially mitigating antitrust concerns. Although the entry of new players has driven up the valuations of Nvidia and AMD stocks, signaling robust growth prospects, investors are advised to consider current market prices. Nvidia, despite its high valuation, appears to offer a more compelling investment opportunity compared to AMD, especially when considering forward price-to-earnings ratios. Prudent investors might find it strategic to await potential price corrections before committing to these leading AI chip manufacturers.

The continuous innovation spurred by new entrants in the AI chip industry, combined with the strategic adaptability of market leaders, creates a dynamic environment where technological advancements flourish. This symbiotic relationship not only propels the entire AI sector forward but also promises a future rich with further breakthroughs and expanded applications, ultimately benefiting society through more intelligent and efficient systems.