Affordability Takes Center Stage: The New Catalysts for UK House Price Appreciation

Understanding the Market's Driving Force: Scarcity Fuels Growth in Accessible Areas

A notable phenomenon in the current real estate climate is the disproportionate increase in property values within more economically viable areas. This upward trajectory is largely attributable to a limited availability of homes in these desirable, lower-priced locales. The West Midlands and various parts of Scotland, for instance, are experiencing annual price increases of two to three percent, surpassing the national average. This indicates a heightened demand where supply is constrained, leading to competitive market conditions.

The Rise of Value-Driven Locations: Blackburn, Falkirk, and Wigan Emerge as Hotspots

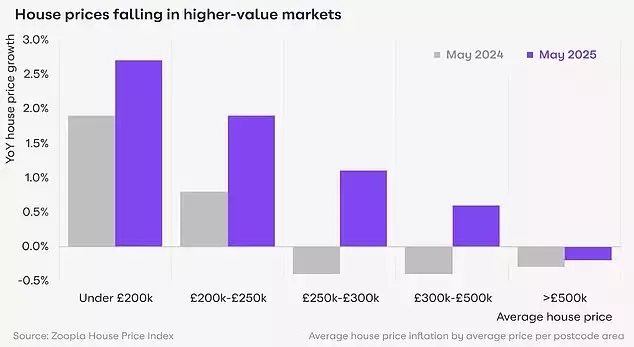

Statistical findings confirm that regions with average house prices below £200,000 are at the forefront of this growth. Specifically, areas such as Blackburn, Falkirk, and Wigan have recorded substantial property value increases, with some reaching as high as 3.5 percent. This trend extends to properties valued between £200,000 and £250,000, which have seen a 1.9 percent rise. These price brackets collectively represent half of the total housing stock, underscoring the broad impact of this affordability-driven surge.

National Market Overview: Shifting Dynamics and Regional Disparities in Property Listings

Across the United Kingdom, the pace of house price appreciation has moderated to 1.4 percent. This slowdown coincides with a notable 14 percent increase in the number of properties available for sale, providing purchasers with a wider array of choices and tempering price escalations. Conversely, high-value markets, particularly London and the South East, are characterized by a surplus of listings and extended marketing periods for homes. These affluent areas have experienced only marginal price growth, remaining below 0.5 percent over the past year, reflecting a saturated market for premium properties.

The Waiting Game: Prolonged Sales Cycles for High-Value Homes

Data reveals that a significant portion of properties that have remained on the market for over half a year, specifically 29 percent, carry asking prices of £500,000 or more. This illustrates the challenge faced by sellers in higher-priced segments, where buyer caution is more pronounced. The overall average time to finalize a property sale across Britain is 45 days, yet this period stretches to 50 days in the southern regions and Wales, contrasting sharply with the quicker 37-day average in the North East of England.

Strategic Pricing: A Key to Success in a Shifting Market

Experts emphasize the critical need for sellers to adopt a pragmatic approach to pricing, especially if they are committed to securing a transaction in the current year. Approximately 22 percent of homes listed have lingered on the market for more than six months without attracting a successful offer, highlighting the importance of competitive and realistic valuations. The average estate agent now manages 37 listings, an increase from 32 last year, suggesting a more active selling environment. This increased inventory has correlated with a 6 percent rise in agreed sales compared to the previous year, signaling a healthier balance between supply and demand.

Expert Outlook: Sustained Buyer Engagement Amidst Price Sensitivity

Industry leaders observe a continued willingness among households to relocate, evidenced by the year-on-year increase in property transactions. Anticipated improvements in mortgage accessibility are expected to bolster purchasing power in the latter half of the year. However, buyers remain highly attuned to pricing, particularly in more expensive markets where increased inventory offers greater negotiating leverage. The market is projected to see a 5 percent increase in sales volume for the current year, with property value increases settling between 1 and 2 percent, indicating a stable yet discerning market.

Recent Market Adjustments: Halifax Report and Overall Averages

Recent reports from Halifax noted a marginal month-on-month dip in average property prices in May, with a typical home experiencing a slight decrease of £1,150, or 0.4 percent. Despite this minor monthly fluctuation, property values have appreciated by 2.5 percent, or over £7,000, on an annual basis, demonstrating underlying resilience. The average UK property is now valued at £268,400, marking a £3,960 increase from a year prior, as reported by Zoopla.