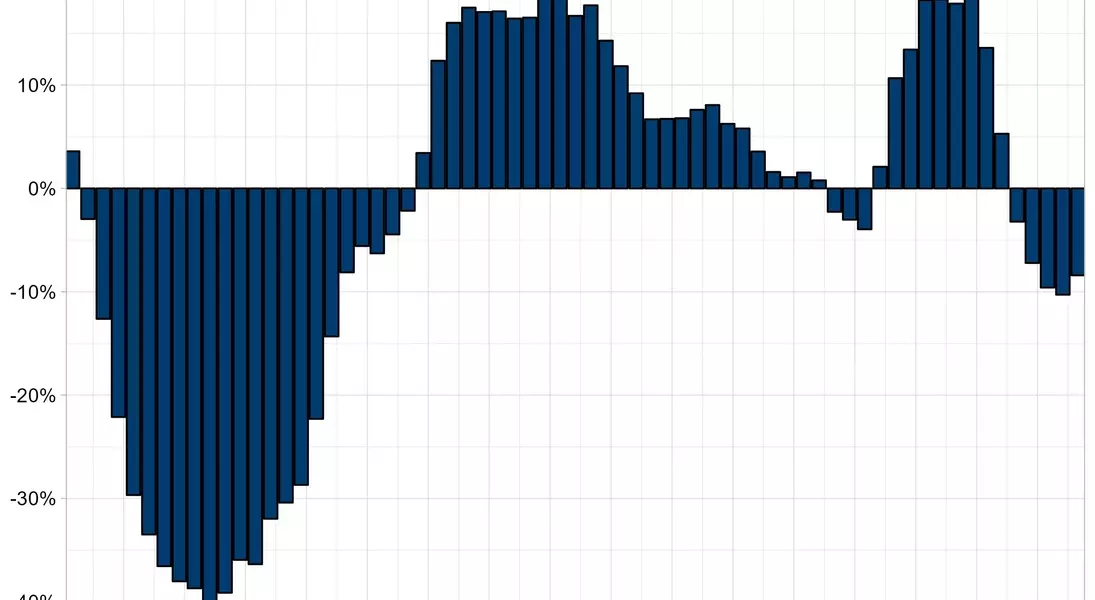

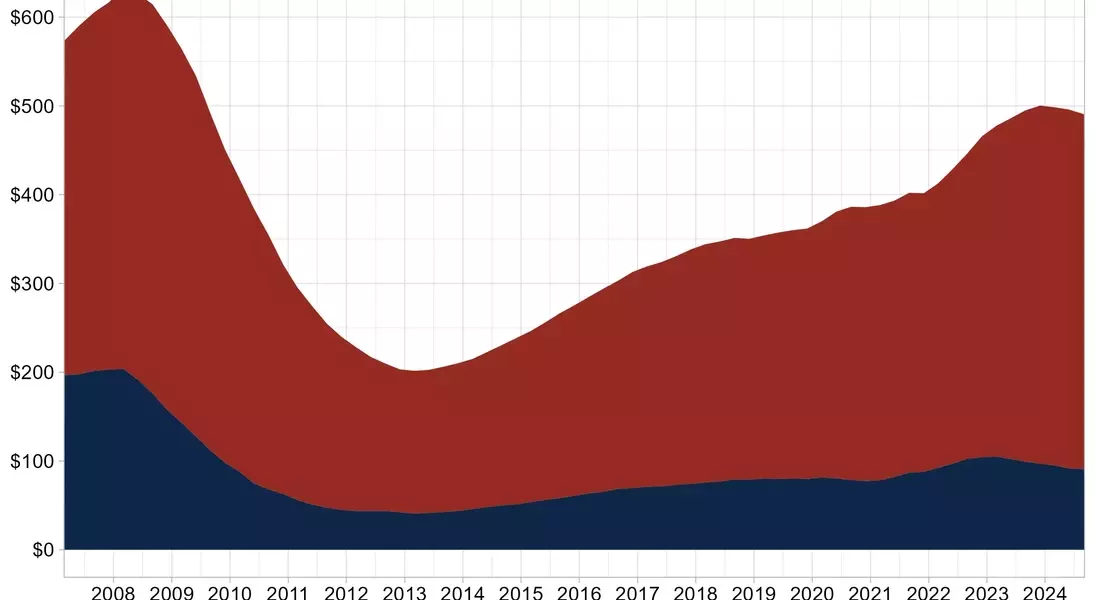

In the third quarter of 2024, the total volume of acquisition, development, and construction (AD&C) loans issued by FDIC-insured institutions saw a drop for the third consecutive quarter. The amount fell from $495.8 billion in the second quarter to $490.7 billion. Despite this decline, there are signs that future lending conditions may improve as the Federal Reserve continues its easing cycle. However, challenges such as higher government deficits and economic uncertainty remain potential obstacles.

Details of AD&C Loan Trends in Q3 2024

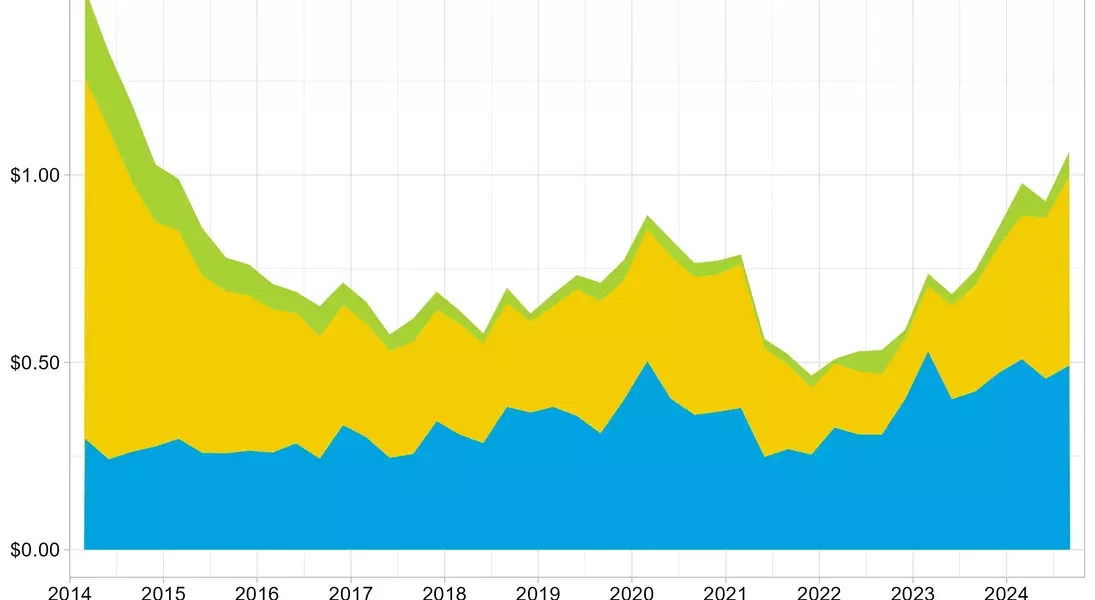

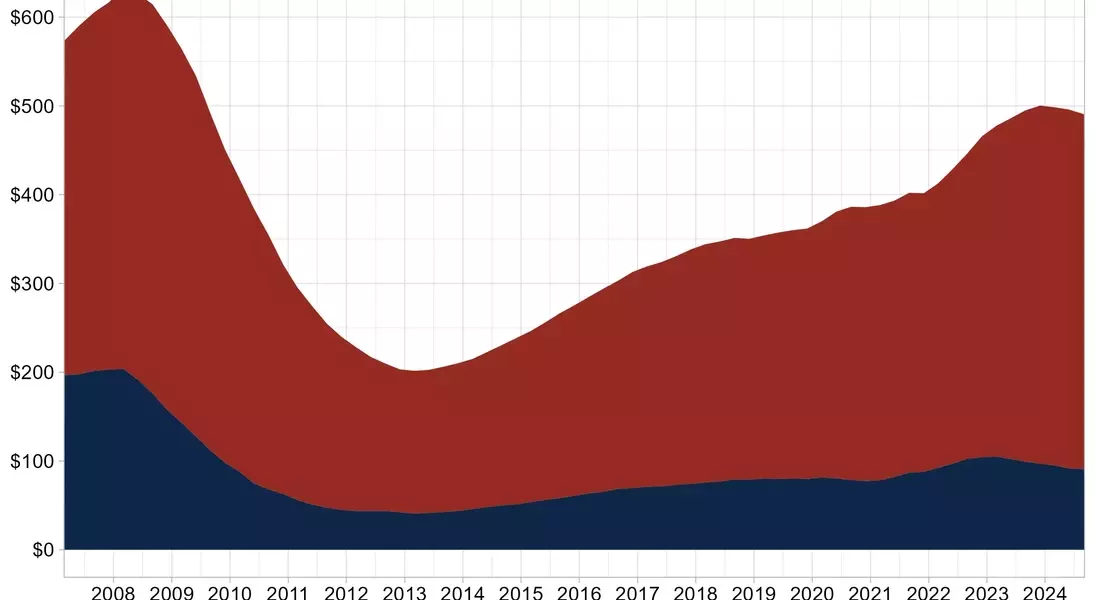

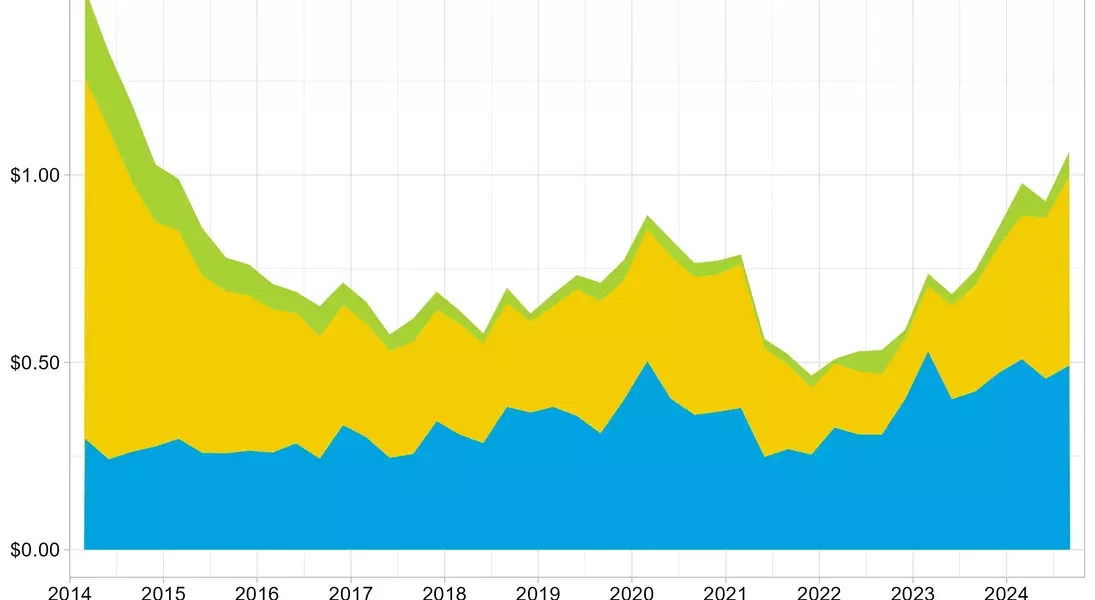

In the golden autumn of 2024, the financial landscape was marked by a significant shift in AD&C loan volumes. Specifically, loans for residential construction and land development experienced a notable decrease, totaling $90.8 billion in the third quarter—a decline of 8.4% compared to the same period last year. This marks the fifth consecutive quarter where outstanding loan volumes have dropped year-over-year. Meanwhile, other real estate development loans also saw a modest reduction, standing at $399.9 billion for the quarter, down $4.3 billion from the previous three months.

It's important to note that these figures represent only the stock of loans and not changes in underlying flows, making them an imperfect measure. Nonetheless, they highlight a significant reduction in lending activity. Current levels of residential AD&C loans are now 55% lower than their peak in the first quarter of 2008. Alternative financing sources, including equity partnerships, have increasingly filled this gap in recent years.

Furthermore, the third quarter witnessed a concerning rise in past-due and nonaccrual residential AD&C loans, surpassing $1 billion for the first time since 2014. Of this total, $505.9 million were in nonaccrual status, indicating that lenders do not expect repayment. Loans 30-89 days overdue accounted for $491.5 million, while those 90 days or more overdue totaled $65.4 million. These delinquent loans represent 1.2% of the total outstanding residential AD&C loans.

From a journalist's perspective, this data underscores the ongoing challenges faced by the housing market. While the Fed's easing measures offer some hope for improved lending conditions, the rise in delinquencies serves as a cautionary signal. It suggests that despite policy efforts, the sector remains vulnerable to broader economic pressures. For readers, this highlights the importance of staying informed about both regulatory changes and market trends to better navigate the evolving financial environment.