Binance's BTC Futures Surge Signals Volatility Ahead

Binance, the leading cryptocurrency exchange, has witnessed a significant spike in Bitcoin (BTC) Futures open contracts, signaling increased market interest and potential volatility ahead of crucial economic data and a high-profile crypto event.Riding the Wave of Anticipation: Binance's BTC Futures Surge

Binance's BTC Futures Soar Ahead of Key Events

Binance's Bitcoin Futures open contracts have surged from around 85,000 BTC to 90,000 BTC this week, a nearly 7% increase. This spike in Open Interest (OI) on the exchange suggests that speculators are positioning themselves for potential price movements in the coming days.The timing of this surge is particularly noteworthy, as it coincides with the upcoming release of critical U.S. economic data, the Personal Consumption Expenditure (PCE) Index, and the anticipated release of former Binance CEO Changpeng Zhao (CZ) from jail on September 29th.Speculators Bet on BTC Ahead of Economic Data and CZ's Release

Market observers believe that the increase in BTC Futures OI on Binance is driven by speculators who are anticipating a potential BTC price rally ahead of the PCE data release. The PCE Index is a key metric used by the Federal Reserve to gauge inflation, and its outcome could influence the central bank's future interest rate decisions.Additionally, the release of CZ from jail is seen as a significant event in the crypto community, as it could have implications for Binance's operations and the broader cryptocurrency market. Speculators appear to be positioning themselves to capitalize on any market movements that may arise from these events.Volatility Ahead: Potential for Liquidations and Price Swings

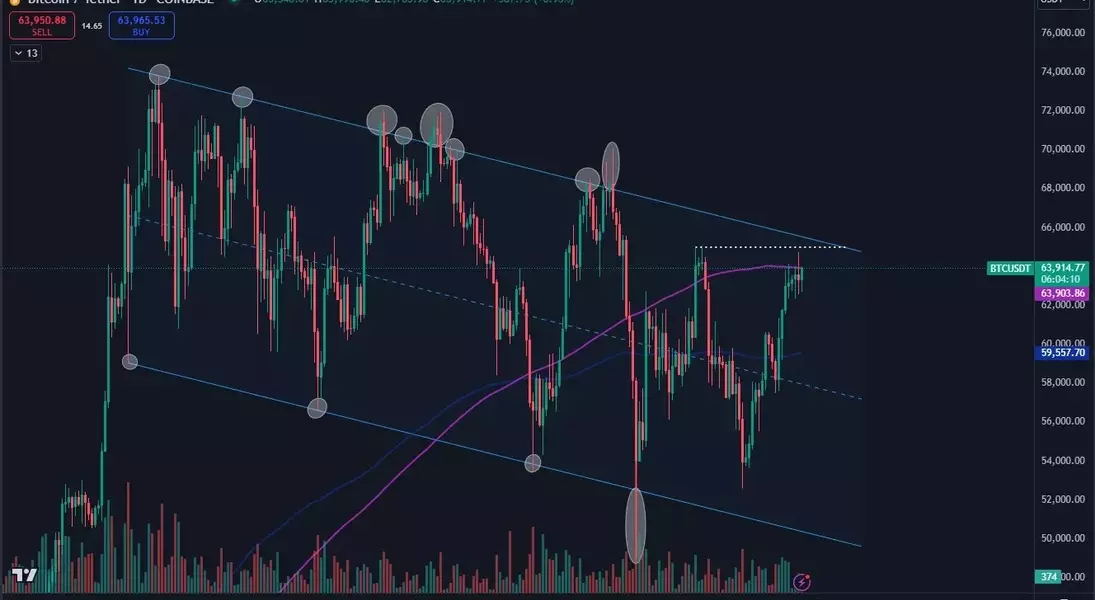

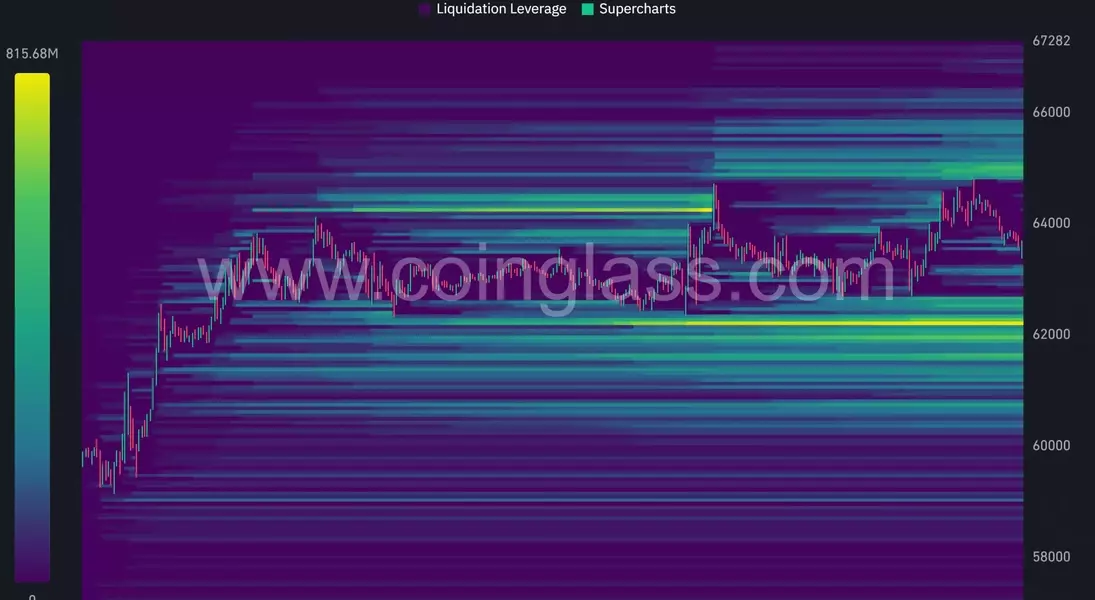

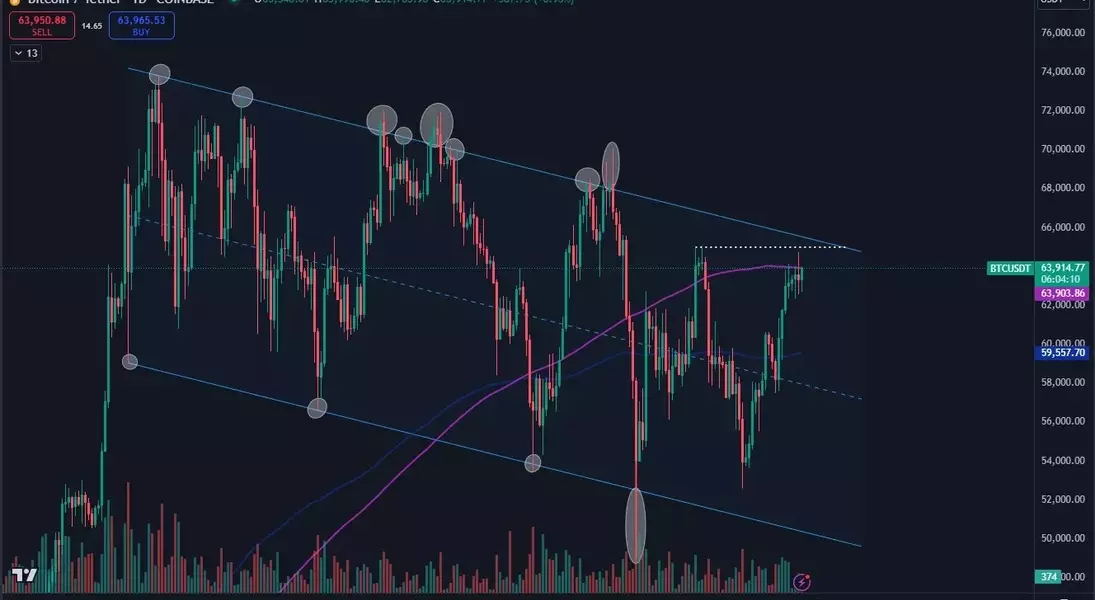

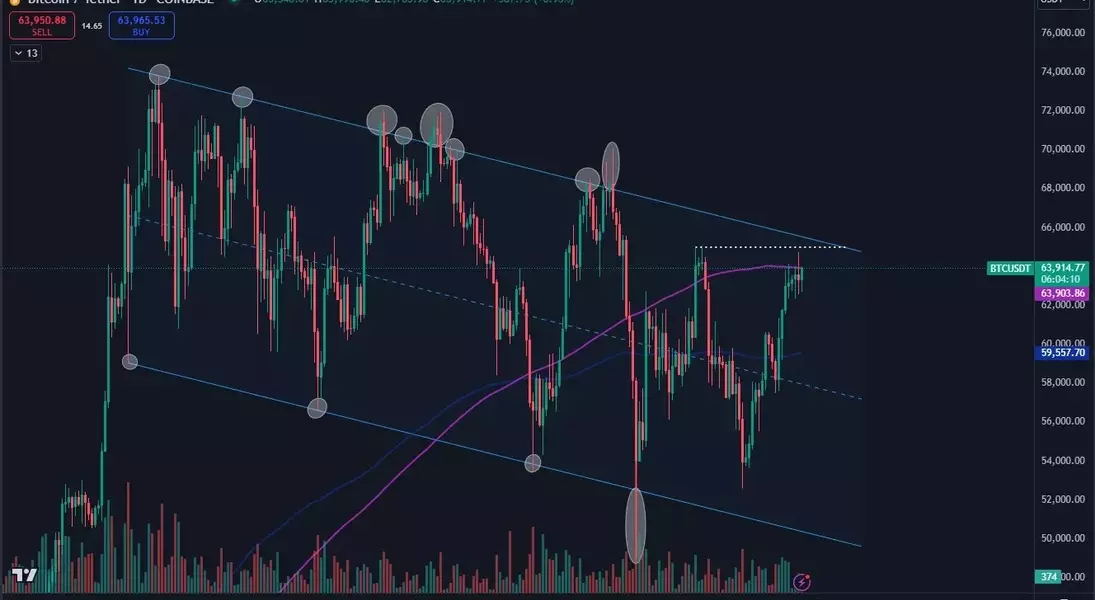

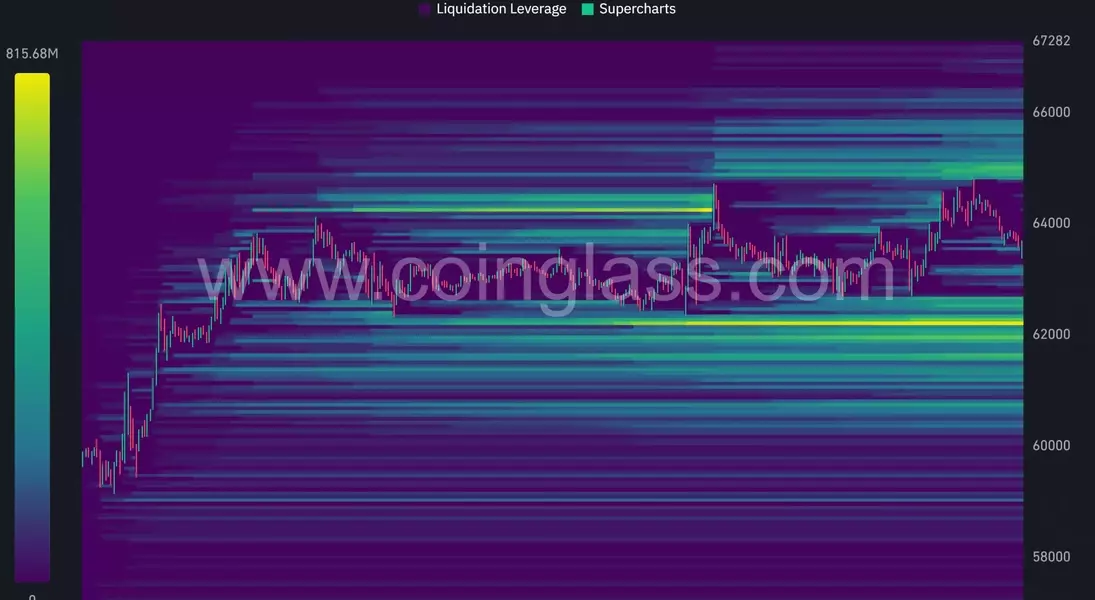

The surge in BTC Futures OI on Binance also exposes speculators to the risk of massive liquidations, which could further exacerbate price volatility. According to Coinglass's 1-week liquidation map, key levels to watch are at $62,000 and $65,000, with significant short positions building up near the $65,000 mark.A sharp move above $65,000 could trigger a short squeeze, leading to substantial losses for bearish traders. Conversely, a wild retest of the $62,200 area could result in over $800 million worth of long positions being liquidated, potentially causing further price swings.Bitcoin's Technical Outlook: Navigating the 200-Day Moving Average

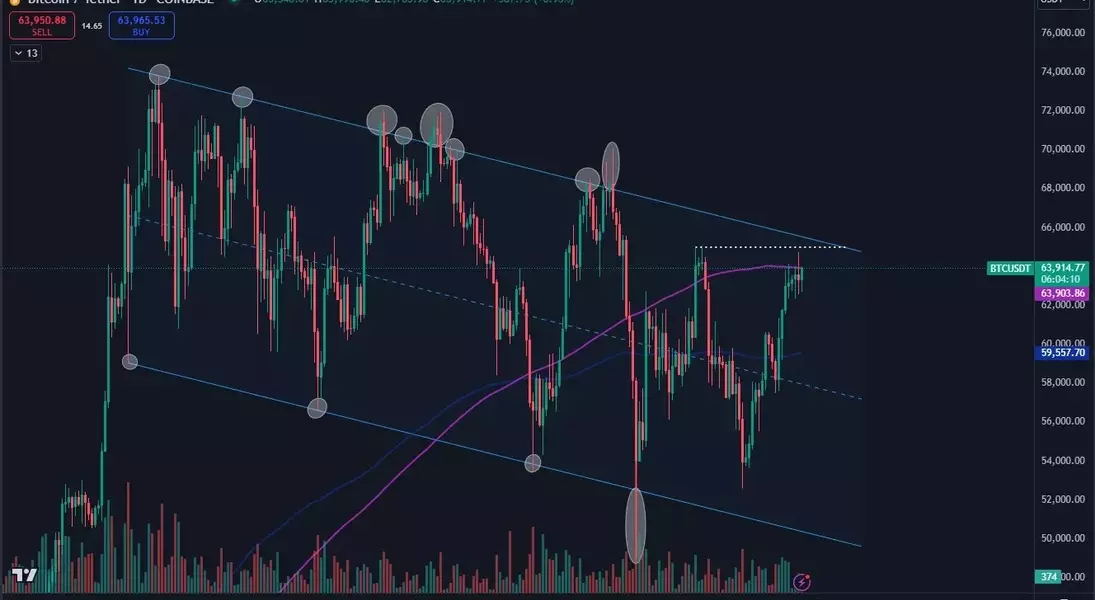

Bitcoin's price action has remained below the crucial $64,000 level, and it has failed to surpass the 200-day Moving Average (MA), which stood at $63,900 at the time of writing. According to trader Daan Crypto, a strong move above the 200-day MA and the current trading channel could mark a bullish market structure shift, potentially accelerating BTC towards its all-time high.However, such an upside move could also trigger a short squeeze, exposing bears to significant losses. It remains to be seen whether the upcoming events and market catalysts will be enough to propel BTC above the $65,000 resistance level and sustain a breakout.Navigating the Volatility: Opportunities and Risks Ahead

The surge in Binance's BTC Futures OI underscores the heightened market interest and anticipation surrounding the upcoming economic data and CZ's release. While this could potentially lead to increased volatility and price swings, it also presents opportunities for savvy traders and investors to capitalize on market movements.However, the risk of liquidations and the potential for sharp price fluctuations should not be overlooked. Traders and investors must exercise caution and employ risk management strategies to navigate the volatile landscape effectively.As the crypto community eagerly awaits the unfolding of these events, the coming days and weeks could prove to be a critical period for Bitcoin and the broader cryptocurrency market.